It is not uncommon to have guidelines within an investment portfolio. In fact, to generate repeatable results an investor should have some parameters in place to assure that an investment approach is reliable, repeatable, and consistent. However, sometimes screening methodologies are introduced to quickly eliminate companies from a broader list towards a shorter investable universe.

In this paper we discuss one of the more broadly used screening approaches when it comes to dividend investing, using a threshold for the minimum dividend yield.

Dividend Yield Threshold

Several strategies and ETFs apply quantitative screens with arbitrary yield thresholds to whittle down the universe of potential companies. For example, ETFs based on the S&P Dividend Growers Index will only be able to consider 75% of the investable universe as index rules exclude the top 25% highest yielding companies from consideration.1

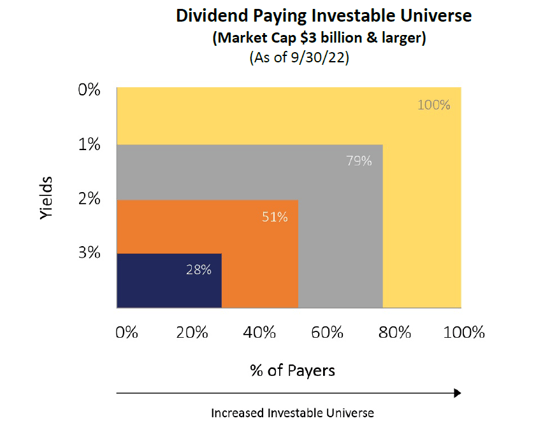

Alternatively, some active managers apply a set threshold, typically 2%, as the minimum yield a company must have to be considered for their portfolio. To get a sense for the distribution of the mid-large cap dividend paying company universe, we looked at all dividend payers with a minimum market cap of $3 billion and higher, and then sorted by their yield. As seen below, 49% of the companies in the dividend paying investable universe have yields below 2%. A manager following the 2% minimum yield rule would have to omit almost half of the investable universe from further consideration. In fact, even if the bar was lowered to 1%, a manager would miss 21% of the investable universe.

Regardless of the yield level, applying a dividend yield threshold omits a significant percentage of companies from the investable universe, several of which are market leading companies that demonstrate consistent dividend growth.

Source: Factset Research, Brentview Investment Management Research

Birds of a feather flock together?

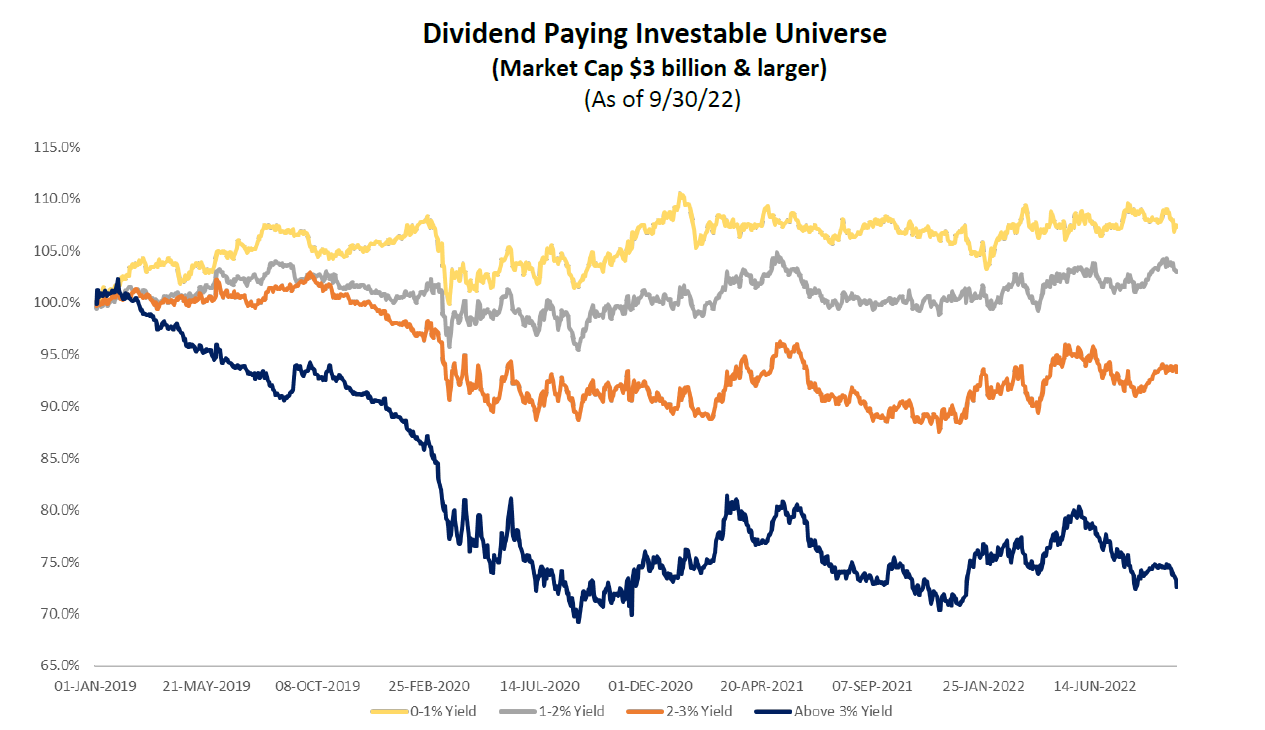

As far as the dividend paying universe goes, not all will behave the same way. The second drawback of not taking a wider view of the investable universe is that performance by yield categories can vary. Our research has shown that by omitting lower yielding stocks, an investor would not only omit a sizeable portion of the dividend paying universe, but also miss out on tremendous levels of alpha.

Taking the 4 different dividend yield cohorts: 0-1% yield, 1-2% yield, 2-3% yield, and above 3% yield we compared relative performance vs. the S&P 500 index going back to 2019. When looking at the results, the lowest yielding segment of stocks outperformed their higher yielding counterparts by a significant amount. In addition, this same segment demonstrated greater resilience and lower volatility vs. the broader index.

Source: Factset Research, Brentview Investment Management Research

Source: Factset Research, Brentview Investment Management Research

Potential Risks with rules

To create a diversified, repeatable process, it’s important to have criteria in place. Criteria exist within a portfolio to mitigate risk and improve the chances of success. Given the changing landscape of today’s dividend payers, setting minimum dividend thresholds may not be risk mitigators. In fact, as the previous illustrations have shown, these minimum yield rules may likely introduce unintended risks, such as sector concentrations or higher interest rate sensitivities.

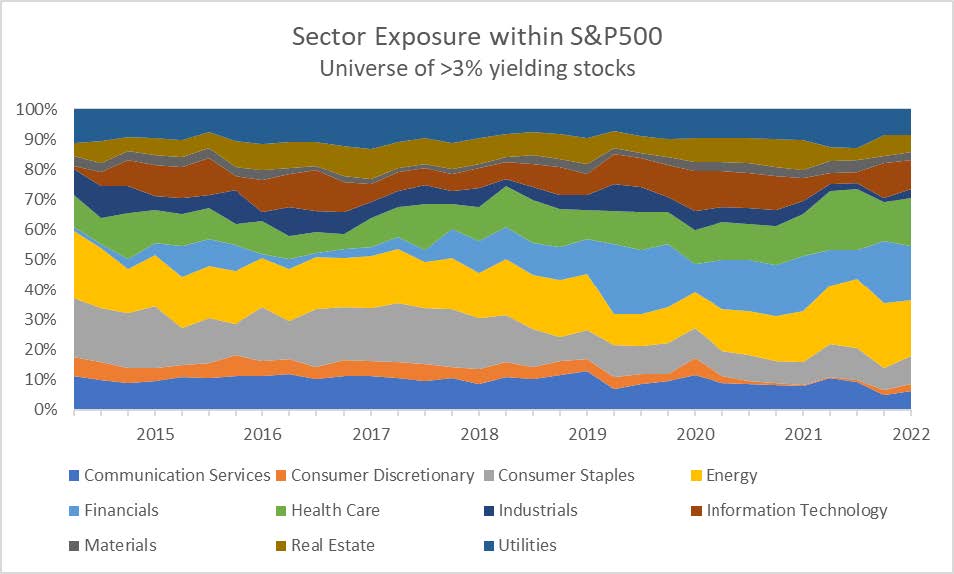

For example, if an investor implemented a minimum dividend yield of 3%, the allocation by GICS sectors would immediately show concentration within that “greater than 3% universe”. Both portfolio allocation and diversification risks would really jump out.

As seen in the chart below, significantly weighted GICS sectors, like Information Technology, would consistently be incredibly underrepresented. More importantly, when yield is the primary focus, slow growth/higher yield sectors are more emphasized, which may increase interest rate sensitivity and volatility.

Due to the 3% screen, Staples and Energy would represent over 40% of the universe and would also have significant representation consistently through time. As discussed in our other valued added piece titled “Looking to yield some performance alpha? Look past dividend yield alone.” a “greater than 3%” yield portfolio dramatically underperformed the S&P 500 as well.

All said, an investor focused solely on yield may take on sector concentration and potential performance risk because of the significant portfolio tilts.

Source: Factset Research, Brentview Investment Management Research

Source: Factset Research, Brentview Investment Management Research

Conclusion

While dividend yield is important, it’s not the only factor to consider when selecting a business or building a portfolio. The investable universe of dividend paying equities provides several great companies and is a strong cohort of equities to draw from. To thoroughly maximize the opportunity, fundamental research is required versus arbitrary rules. As an equity investor what should matter is the commitment to growing dividends driven by a strong and robust fundamental business Several very well-run companies will never meet a higher dividend screen as they are frequently “a victim of their own success”; a rising stock price and falling dividend yields because of the appreciation. Conversely, yield maximizing strategies emphasize rules which may introduce other risks such as concentration risk, interest rate risk, and performance risk.

Eliminating these overly restrictive rules allows an investor to take full advantage of the dividend landscape and create a portfolio with broader economic exposure. In addition, this less constrained portfolio could potentially consider recent dividend initiators and the faster growing lower yielders segment. The result of this broader opportunity set could be greater performance consistency which may improve the chances of investment success over time.

Sources:

1 www.spglobal.com/spdji/en/indices/strategy/sp-us-dividend-growers-index/#overview

This commentary reflects the views of Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Updated: September 2022

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|