There is no shortage of research on the benefits of dividend investing. The most tangible benefit is the consistent occurring cashflow that comes into a portfolio as dividends are paid. Investors not only benefit from compounding over time, but their portfolio may benefit from lessened swings in value due to the consistent inflow of dividend payments1.

Our experience has shown that when choosing dividend payers, there are three important characteristics when choosing companies.

Part 1: Go Beyond Yield

Part 2: Dividend growth leads to better governance and company quality

A company’s risk profile is always changing

Part 2: Dividend Growth Leads to Better Governance and Company Quality

The 1990’s are frequently used as an example of a speculative bubble that exceeded expectations, specifically in the “dot com” oriented internet companies. Executives of these companies were heavily incentivized via stock option benefits to run their respective businesses to increase the market value and grow the stock price. Increasing company franchise value is the goal of every business owner. However, the short-term nature of stock options, which can expire worthless, created an incentive that was misaligned with longer-term stockholders. For example, the shareholder friendly act of paying a dividend makes stock options worth less as option pricing requires that the value of the dividend payments is subtracted from the value of the option. Needless to say, not many corporate managers would willingly take this action as it negatively impacts their net worth! As a result of this mismatch, management teams became more focused on short-term objectives versus building businesses that were built to last for the benefit of shareholders. The bursting of the dot com bubble showed that managers needed an alignment in incentives. Expediting the changes in option issuance came from the Financial Accounting Standards Board; FAS123R, which was an accounting rule that mandated expensing options against income as opposed to footnoting. Enter the concept of RSU’s, restricted stock units.

Ever since the decade of the 90’s the utilization of restricted stock units has grown in utilization and stock options, while still used, have diminished1. The compensation change now drives management decisions that are longer-term in nature and aligned with shareholders. Additionally, the issuance of dividends and growth of dividends are both incentivized. The main reason is that dividends are received by RSU’s as well and are no longer a detractor as they were in the stock option era. While executive compensation is important from a governance perspective, the use and deployment of capital may also impact facets of company quality.

Companies have several ways to deploy their capital. A company can reinvest in its business via acquisitions, capital expenditures, share buybacks, or paying a dividend. Among those three items a cash payment, such as a dividend, is a significant commitment to shareholders as it is recurring over time and is a cash payment to every shareholder. Share buybacks may be announced but may not be fully implemented or implemented at all. Committing to dividend growth is an even larger pledge to shareholders. Why? In order to deliver growth of that dividend, companies have to institute cost controls and operational governance that leads to better consistency. The operational consistency flows through towards consistent dividend growth and is derived from a well-run company.

A Company’s Risk Profile is Always Changing

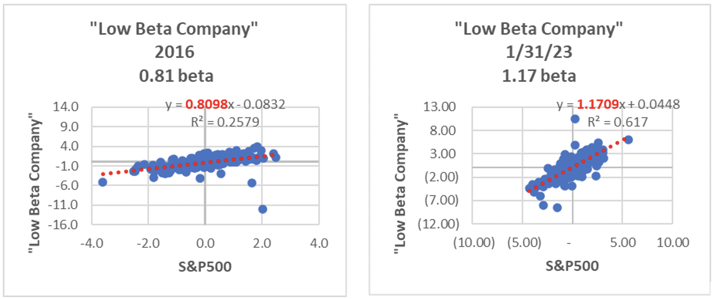

Finding a solution to address rising volatility many investors flocked to exchange traded funds or stock screens to find “Low Beta” stocks. Beta, like standard deviation, is a measure of risk. In the case of beta, this factor measures the sensitivity of one security to the broader market, for example the S&P500. If a security has a beta of 0.80, it has 80% sensitivity to any change of the S&P500, which is assumed to have a beta of 1 since it is the market benchmark. For example, if the S&P500 were to decline by 1%, the company with a beta of .8 should decline by 0.80%, all things being equal.

While beta is a good approximation of risk, it must be taken into consideration with other measures like standard deviation, or volatility. The other important matter is that risk, no matter how it’s measured, is always changing. As seen in exhibit 3, a company with a lower than market beta (below 1), is shown in 2016. The beta sensitivity to market changes is illustrated by the red trendline.

The flatter the trend line, the lower beta. Conversely, the steeper the trendline, the higher the beta. However, when looking at the trendline from 2016 vs. 2023, one could see that the beta increased to

1.17, which greatly steepened the trendline. The result of this evolution was that the once low beta company with limited sensitivity was now moving with greater sensitivity than the broader market.

Exhibit 3: Evolution of Company Beta

Source: Factset Research: For a description of the methodology, see the Endnotes for Exhibit 2

Interestingly, this same phenomenon can happen to entire sectors as well. In 2007 financials were low beta but by mid-2008 almost the entire sector transformed toward high beta as the credit crisis unfolded. Risk like all things needs to be managed, monitored, and addressed.

Dividend Growth Within Portfolios

Given the previously mentioned benefits, the case for dividend growth remains strong from a risk/reward perspective. Ultimately, the continued payment and growth of dividends can be viewed as a sign of a company’s commitment to their shareholders and the quality of the underlying business. These characteristics create a strong reason for including companies into a diversified portfolio that possess shareholder friendly dividend policies, strong balance sheets, and fundamental strength for future dividend growth.

Many companies are well positioned to continue to increase their dividends over the long term. As a result, corporate management teams have the means and motivation to focus more on dividend growth as a way of rewarding shareholders.

Footnotes & Sources:

1 Murphy, Kevin (2012, August 12) Executive Compensation: Where We Are, and How We Got There

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2041679

Endnotes

Evolution of Company Beta (Exhibit 3) Daily return values were collected, regressed, and graphed in the scatter chart. The trend line with best fit to the plotted information was inserted into the chart. The slope of the trend line with the “least squares fit” arrives at the calculated security beta. The chart was created with Information derived from Factset Research Systems.

Beta: A measure of risk that tracks the relative volatility of an investment versus a corresponding benchmark. A beta of 1 indicates that the investment has historically moved in-sync with the benchmark. An investment with a beta greater than 1 indicates that the investment has been more volatile than the benchmark overall. For example, a beta of 1.5 means that the investment is 1.5 times more volatile than the benchmark. An investment with a beta less than 1 indicates that the investment is has been less volatile than the benchmark.

Diversification: The practice of investing in multiple asset classes and or securities with different risk characteristics to reduce the risk of owning any single investment.

Dividend Growth Rate: The annualized percentage rate of growth that a particular stock's dividend undergoes over a period of time.

Dividend yield: for a company’s stock, the ratio of the dividends paid out by the company each year per share to the share’s current market price.

Earnings per Share (EPS): the portion of a company’s profit allocated to each share of common stock. Earnings per share serve as an indicator of a company’s profitability.

Payout ratio: the percentage of earnings paid to shareholders in dividends.

Price/earnings ratio (P/E ratio): the ratio of a stock’s current price to its per share earnings over the past year. For a fund, the ratio is the weighted average P/E of the stocks in the fund’s portfolio. A forward P/E uses estimated earnings for the next four quarters in the denominator. P/E is often an indicator of market expectations about corporate prospects; usually, the higher the P/E, the greater the expectations for a company’s future growth in earnings.

Recession: defined as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

Standard deviation: a measure of the degree to which returns varied from the average return over a certain period. It is a common measure of volatility

and risk.

S&P 500®: an unmanaged index generally considered representative of the U.S. stock market.

Volatility: The amount and frequency of fluctuations in the price of a security, commodity, or a market within a specified time period. Generally, an investment with high volatility is said to have higher risk since there is an increased chance that the price of the security will have fallen when an investor wants to sell.

Risks and other important considerations

PROVIDED FOR INFORMATIONAL PURPOSES ONLY. This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors. Investing entails risk, including the possible loss of principal. There can be no assurance that any investment or asset class will provide positive performance over any period of time. Dividend yield is one component of performance and should not be the only consideration for investment. Dividends are not guaranteed and will fluctuate. Equity investments such as large-cap stocks are subject to market risk or the risk of decline in response to adverse company news, industry developments, or a general economic decline. Past performance does not guarantee future results.

The statements contained herein reflect the opinions of Brentview Investment Management, LLC (“Brentview”) as of the date written. Certain statements are forward looking and/or based on current expectations, projections, and information currently available to Brentview. Such statements may or may not be accurate over the long-term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ from those we anticipate. We cannot assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Statistical data was taken from sources which we deem to be reliable, but their accuracy cannot be guaranteed.

Brentview Investment Management, LLC, is a registered investment adviser.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|