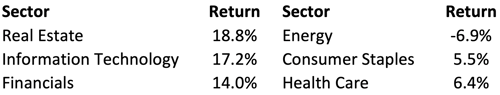

The fourth quarter of 2023 saw the S&P 500 index climb 11.68% after the market experienced a 10% correction in the month of October. The market broadened out as the equally weighted S&P 500 rose almost identically to the market capitalization weighted S&P 500. The top & bottom three sectors of the S&P 500 are shown in Table 1 based on quarterly performance. The sector winners were real estate, technology, and financials. The laggards were energy, consumer staples, and health care. Energy was the only sector in the fourth quarter to post a negative return during the quarter.

Table 1 (as of 12/31/2023)

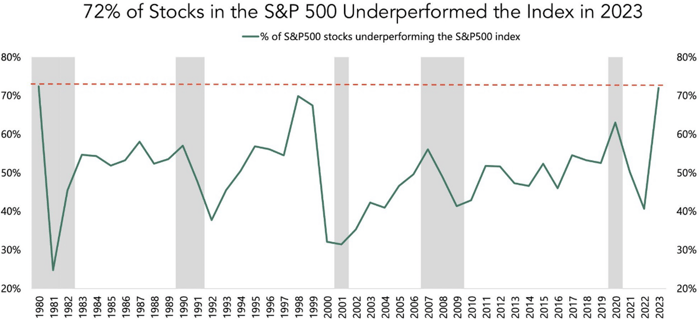

The Brentview Dividend Growth Portfolio slightly underperformed the S&P 500 in the fourth quarter. However, for a large up period, we still captured over 93% of the upside. For the full year, the S&P 500 climbed 24.23% while the Dow Jones index and the NASDAQ rose 13.8% and 43.42%, respectively. 2023 marked a period of narrow performance, with very few companies outpacing the market. In fact, when looking at the S&P 500 index, 72% of the constituent holdings underperformed the index, a level not seen since 1980 as seen in Chart 1. What’s even more interesting is that these narrow markets are typically short lived, which creates a good opportunity for active management.

Chart 1

Source: Bloomberg

During the year, non-dividend paying stocks were up over 50%, which is not a favorable environment for dividend investing styles. As seen in Table 2, the performance contribution for three sectors was dominated by several non-dividend paying companies. For example, the communications services sector returned 56.4% for 2023. When returns are allocated to the responsible companies, Alphabet (A&C share class), and Meta Platforms, were collectively responsible for 86% of the communication services sector’s return, or 48.5% in total. The same relationship was true for the consumer discretionary and information technology sectors as well.

Table 2 (as of 12/31/2023)

Source: Factset Research

All Eyes on Macro

The economy has proven resilient when considering economic indicators trending downwards for over a year. The Federal Reserve has been highly restrictive to rein in rampant inflation that was

initially viewed as transitory. In addition, the tight labor market appears to be slowly softening which could curtail wage growth, a key metric that the Federal Reserve looks at. Overall, the Fed’s restrictive policies appear to be working as inflation is nearing their 2% target. Longer-term interest rates (10 and 30 year) peaked at 5% before dropping below 4%. Within our economy it appears that China’s economic woes are supporting goods deflation while counteracting services inflation has shown to be stickier. Oil prices are often a wildcard for inflation during periods with geopolitical turmoil such as we have today. However, shale oil production in the US is increasing and OPEC+’s unity is weakened by Angola’s recent departure following other exits by Ecuador (2020) and Qatar (2019).

Several factors point to a good year for equities in 2024, some based solely on historical statistical data. For example, Presidential election years are usually positive periods nearly 90% of the time.1 Any year following a 20% rise in the stock market (2023) is typically followed by a 10% average gain.2 Moreover, the first positive year (2023) after a negative year (2022) is followed by a positive year 100% of the time (11) since 1957, the year the S&P 500 was created.3

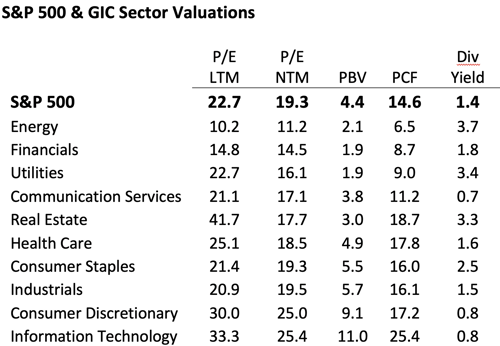

However, one major factor that counters this bullish scenario is the valuation for the S&P 500 (19.3x 2024 at this writing). For the market, current valuations measures are trading near the upper range of historical PEs over the last 10 years. However, we think this obstacle can be overcome by sector rotation. When looking more broadly, certain sectors trade below the market multiple. As seen in Table 3, these sectors include energy financials, utilities, communication services, real estate, and health care. These sectors just might be your 2024 market leaders.

Table 3

With the earnings season in full swing, estimates for 2024 and 2025 are both forecasted for a 11.7% growth year over year. Concerns of an earnings recession now look to be in the rear-view mirror. However, it will be important to see if price hikes stick and input cost inflation moderates. All said, lower interest rates should lower interest expense and thus improve profit margins.

Much has been said for the trillions of cash sitting on the sidelines in money market instruments. What seems more compelling is cash held by private equity investors finally coming off the sidelines. With recession fears diminished, and lower interest rates on the horizon, we expect private equity to either deploy capital, take companies public, conduct spinouts or restructuring. The result is that any of these activities could be supportive of company valuations.

Dividend Growth Scorecard

According to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, in 4Q 2023, the cumulative dollar value of U.S. common stock dividends per share posted a 5.5% increase for the trailing twelve months4. More importantly, income growth (actual cash for a representative account) was up 7% in 2023. Income growth for the year 2024 will also be off to a good start as we saw two companies announce special dividend payments, which arrive in January.

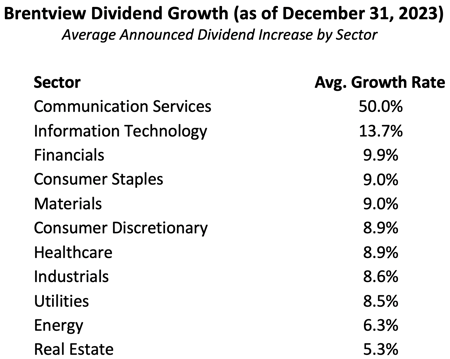

As seen in Table 4, on a year-to-date basis, all eleven GICS sectors have seen a dividend increase in 2023. For the year, thirty-four of our thirty-six holdings (94%) announced dividend increases of 10.7% on average. During the quarter we saw four holdings announce dividend increases. Financial sector holding Visa announced a 15.6% dividend increase. Otherwise, the Information Technology, Financial, and Industrial sectors saw the remainder of the announcements.

Table 4

Source: Factset Research

How is Brentview positioning our portfolios?

The S&P 500 is projected to post a 5.7% increase in dividends. We at Brentview strive for a faster portfolio dividend growth rate, often double digit on average. We made a recent investment in the secular trend of federal infrastructure spending and the onshoring of industrial production. This basic materials company trades at a significant discount to its peer group. We also added a recent dividend initiator that has the capacity for not only pursuing a 10% dividend growth rate but also a significant share buyback program. In health care, we found a company with a lower than market PE multiple, that still allows us to participate in the rapidly growing GLP-1 weight loss drug category. Our adds to existing positions were in a few lagging value stock holdings while at the same time we took profits in the information technology sector.

While 2023 was challenging for dividend payers, the culmination of historical relationships, cash on the sidelines, and opportunities within the dividend paying landscape should portend for a better 2024. As noted, narrow markets will widen which creates ample opportunities for active management.

Sources

1 Morningstar/Ibbotson

2 LPL Research

3 Macrotends.net

4 Press Release dated January 4, 2024 prnewswire.com/news-releases/sp-dow-jones-indices-reports-us-common-indicated-dividend-payments-increase-13-7-billion-in-q4-2023-and-36-5-billion-in-2023--302025109.html

This commentary reflects the views of Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|