The Brentview Dividend Growth strategy ended the year on a strong note, outperforming the S&P 500 for both the fourth quarter as well as for the full calendar year. The S&P 500 ended 2022 with a robust 7.6% return in the quarter, which also lessened the impact from a -18.1% return for the full year. As far as styles were concerned, Large Cap Value handily beat Large Cap Growth for both the fourth quarter and the full calendar year of 2022. It’s important to note that we maintained a portfolio beta of 0.80 for most of the year. Beta is a measure of risk which approximates the relative “sensitivity” to price changes of a corresponding index, in our case, the S&P 500 where the beta is 1. Sometimes cited as the “low beta anomaly”, maximizing beta is not necessarily required to outperform the market. While a low beta portfolio position contributed to the balance of 2022, when markets were under pressure, it did not detract from our 4th quarter relative returns when markets rebounded strongly.

As we have mentioned in past commentaries, (Dividend Growth in an Inflationary Age-June 2022) growth stocks behave in the same manner as any long duration asset. Duration is a bond term that measures the sensitivity of an asset’s price to the corresponding change in interest rates. In general, an investor would seek out long-duration assets when interest rates had the potential for falling in the future. Conversely an investor would seek out short-duration assets when interest rates had the potential for rising in the future. In the 2022 rising rate environment, investors favored equities of cash-flowing companies. In the spectrum of equities, a company with favorable cash-flow was like a “shorter duration” asset relative to those who were not cash flow positive. With positive cash-flow far off in the future, the growth segment was impacted the most by rising interest rates, which reached levels not seen since 2007.

Relative to the S&P 500, the Brentview Dividend Growth Strategy saw strength from stock selection. From a portfolio positioning standpoint, stock selection within the Consumer Discretionary and Information Technology sectors contributed to our quarterly results.

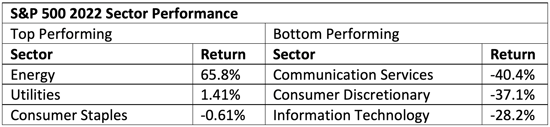

What sectors worked in 2022? As seen in Table 1, Energy had another banner year and returned 65.8%. The sector’s performance was especially surprising given the range of the commodity. During 2022 oil prices started the year in the $70 range, spiked up to over $100 in the spring, only to fall back to the $70’s by year end. The primary reason the energy sector performed well was due to the industry focus on capital discipline. The key was to rein in capital expenditures and focus on returning capital to shareholders. In a challenging environment, while utilities had a small gain, the remaining nine sectors were all in the red.

Table 1

The worst performing sector was Communications Services, which declined by 40%. The sector was primarily driven by the returns of Facebook, Google, Netflix, and Comcast. Similarly, Consumer

Discretionary lost 37% in 2022 due to the detraction from Amazon, Tesla, and Target. Information Technology was off 28% with the subsector semiconductors doing even worse. In short, with several of those companies being non-dividend payers, 2022 rewarded quality dividend payers.

All said, during 2022 an investor had very few places for safe harbor. On a healthy note, however, we had some speculation driven out of the capital markets. 2022 saw IPO’s grinding to halt, special purpose acquisition company (SPACs) with no real underlying business getting liquidated, the FTX crypto collapse, and non-fungible tokens (digital collectibles) plummeting in value. While equities declined as well, the potential for back-to-back losing years in the S&P 500 is rare.

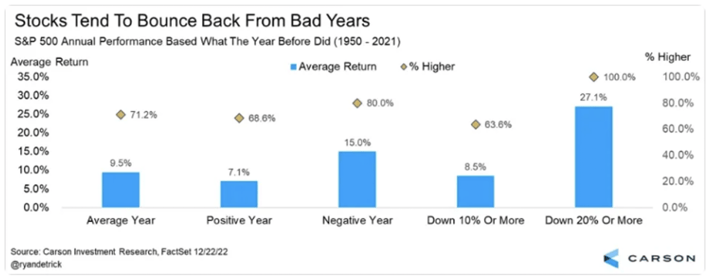

Looking historically, the year after a market decline tends to be positive 17 out of the past 25 years. While not impossible, two losing years in the market historically requires an economic shock or geopolitical event. In recent times, the last occurrence was 2000-2002 during the dot com bubble burst. Prior to that, the OPEC oil embargo in 1973-1974 also generated back-to-back negative returns. Keep in mind, losing years of 20% or more have better odds of being followed by a positive year as seen in Chart 1.

Chart1

So, what’s in store for 2023?

The focus in 2023 will be on inflation, recession, and earnings. Regarding inflation, the focus is still front and center as the Federal Reserve is determined to get inflation down after initially viewing it as “transitory”. More recent economic releases suggest that inflation is coming down as the headline CPI measure, and Fed’s preferred PCE price deflator have shown favorable rates of change. With half of inflation pressures coming from supply constraints, it seems doubtful that inflation will hit the targeted 2% levels in 2023. However, concerns around economic growth are warranted, especially if the Fed’s goal is to stifle demand via higher interest rates.

Many believe a recession is coming in 2023 with some forecasts showing a 100% probability. Right now, technology companies and interest rate sensitive industries like housing are the only areas seeing worker layoffs. A broadening of job losses will be required to get the US economy into a full-blown recession. Currently, the stock market is pricing in a mild recession, which seems the likely route, especially with the economy emulating the 1969-1970 timeframe. The recession during that period was also sparked by an inflationary crisis. That recession lasted 11 months and unemployment rose from 3.5% to 6.1%.

The biggest disconnect today is that S&P 500 earnings estimate for 2023 are forecasted to be up ~5%. During recessions earnings will normally fall 20%-25%. In addition, profit margins are forecasted to be 12.3%, a slight decline from the 12% figure seen in 2022. Historically, profit margins have a 10-year average of 10.3%.

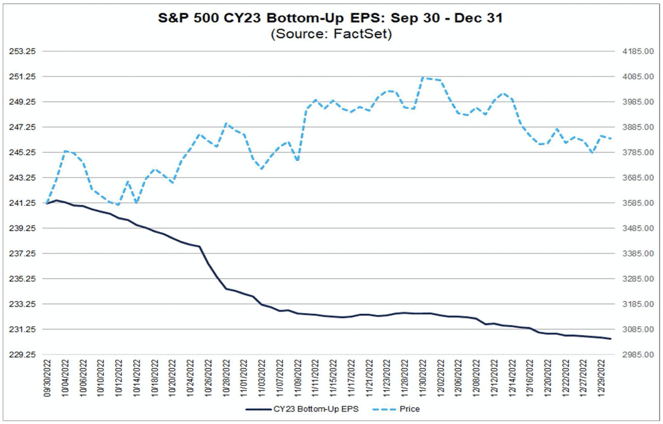

As seen in Chart 2, the 2023 bottom-up earnings estimate for the S&P 500, at the time of this writing, are now at $230.51, which is down 4.4% from the start of the 4th quarter. That 4.4% decline in earnings estimates is the largest 4th quarter decline in estimates since Q4 of 2014. Despite estimates for the S&P 500 going down in the 4th quarter, the forward P/E for the S&P 500 moved up to 16.5x at the end of 2022.

With these current estimates, Consumer Staples, Health Care, and Energy all have a forward P/E that is higher than their respective 5-year averages. Like 2022, we believe that 2023 will be a year where fundamentals and stock selection could have a meaningful impact on returns.

Chart 2

Dividend Growth Scorecard

According to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, in 4Q 2022, common stock dividends in the S&P 500 increased 10.2% for the trailing twelve months. Contrasted to our strategy, thirty-five of the thirty-eight holdings (92%) announced dividend increases of 11% on average through December 31st.

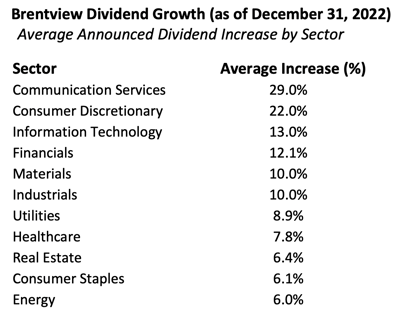

As seen in Table 2, we were glad that our portfolio saw all eleven GICS sectors with dividend increases. The Communication Services sector saw the largest announced average dividend increase during the year. Conversely the Energy sector saw the slowest dividend increase over the last year, but this sector also tends to offer higher dividend yields. The breadth of dividend growth rates directly ties to our desire to have a wide range of dividend yields in our portfolio. Historically, having all sectors represented, along with a broad representation across the dividend yield spectrum, has served our strategy’s consistency well.

Table 2

Source: Public company filings

How is Brentview positioning our portfolios in 2023?

Brentview Dividend Growth has historically resided in the large core style box and currently has a value tilt. We expect value to outperform growth again in 2023. Along those lines, we used recent strength to trim some of our mega-cap technology exposure. We believe these businesses require lower interest rates to propel their growth prospects. The odds of the Federal Reserve pivoting from increasing rates in 2023, to cutting them, is not likely in our current assessment. Similarly, we also selectively trimmed our consumer staples weightings and added to our health care weightings. The defensive consumer staples sector has been bid up and some valuations appear to be rich. In addition, we believe health care has both defensive and offensive characteristics. Finally, we expect REITS (real estate investment trusts) to rebound from their poor showing in 2022 as the category declined 26% during the year.

In the second half of 2022 we identified a few mid cap stocks with low PE multiples that had a history of raising their dividends. It’s important to note that neither of our recent mid-cap positions are in the S&P 500, which increases our portfolio active share. We are excited to find these businesses and believe our singular focus on dividend growth investing can give us an edge to identify companies ahead of our peers. Historically we’ve had success with identifying companies that have “flown under the radar”. Finally, we expect dividend growth rates to moderate from 2022. Currently, S&P 500 dividends per share are estimated to grow in the mid-single digits. With average payouts in the high 40% range, companies have flexibility and will be a factor to watch in our maintenance research.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|