Heading into 2020 it was not uncommon to see metaphors for the forthcoming year as “the year of perfect vision.” However, as the year progressed it became apparent that visibility was anything but clear. For the fourth quarter Dividend Growth slightly underperformed the S&P 500, despite our strategy maintaining a lower beta position. On a gross of fee basis Dividend Growth was up 11.41% for the period versus 12.13% for the S&P 500. For the full year, Brentview returned 12.91% versus 18.39% for the S&P 500.

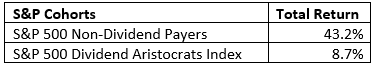

Looking back on 2020, as seen in Table 1, very few would have expected non-payers would perform strongly for the whole year, despite the uncertain economic backdrop. Historically, periods of uncertainty have favored conservative equities, such as dividend paying stocks. The S&P 500 Dividend Aristocrats Index not only lagged our results, but also the S&P 500 for 2020. The S&P 500 Dividend Aristocrats is solely comprised of companies with a minimum history of twenty-five years of contiguous dividend growth. Ultimately the market’s performance in 2020 was driven by non-payers. Given our mandate to only buy dividend paying companies, we could not participate in the non-payer segment. Amazon, Facebook, and Google alone added approximately 250 basis points of total return to the S&P 500 index for the full calendar year.

Table 1 (Source: Standard & Poor’s, Factset)

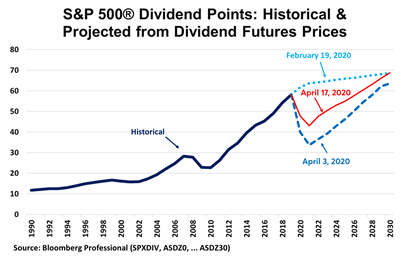

One thing that seemed certain to market pundits was that dividend payments were destined to be slashed whole heartedly. In fact, there was no shortage of pessimism earlier in the year. During the darkest days of the correction, from March into April, S&P 500 dividend future prices fell by an amount that suggested dividend payments were destined for a 40% correction overall as seen in Chart 1. True to form, 2020 delivered the exact opposite.

Chart 1

Analyzing our strategy, inbound dividend payments generated from our portfolio holdings increased by 10.5% year over year. During the 4th quarter alone, nine companies within our portfolio paid out dividends that had increased from the prior year. The S&P 500 Index constituents, according to Standard and Poor’s, had cumulative dividend payments for 2020 that grew by 0.07% for the year. The index saw 42 companies suspending their dividends during the year and the index also had 38 fewer dividend paying constituents at year end. All said, despite the pandemic, eighty two percent of our portfolio holdings made announcements during the year to increase dividends. From our lens, there is no better demonstration of shareholder commitment than dividend increases during this timeframe. Cash-flow generating businesses with strong balance sheets and confidence in their outlook maintained their dividend growth commitment.

Sector Surprise

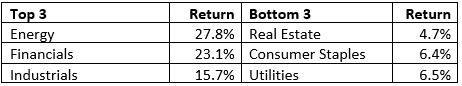

In our previous commentary we alluded to a possible rotation towards value stocks as relative valuations of growth companies to value companies reached all-time highs. The rotation abruptly occurred in the fourth quarter of 2020 as the best performing sectors were Energy, Financials, and Industrials. The Energy sector was particularly volatile as it rebounded from a negative 19.8% return in the third quarter. The worst performing sectors for the fourth quarter were Real Estate, Consumer Staples, and Utilities as seen in Table 2.

Table 2

4Q20 Sector Performance (Source: Standard & Poor’s, Factset)

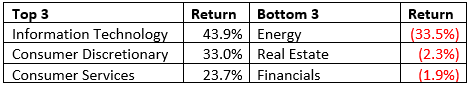

During the onset of Covid-19, it seemed logical at first glance that “defensive sectors” would perform well, especially considering “shelter in place” orders that many states took. Along that line, Utilities, Consumer Staples, and Healthcare all seemed poised to be the clear winners. Despite the uncertainty, the typically safe and high yielding Utility sector ended 2020 with a total return of forty-nine basis points. While the Consumer Staples and Healthcare sectors fared better, they still lagged the broad market overall. Ultimately as seen in Table 3, the best performing sectors were Information Technology, Consumer Discretionary, and Communication Services. Despite the recovery in 4Q, the Energy sector was the worst performing sector for the year followed by Real Estate and Financials.

Table 3

2020 Sector Performance (Source: Standard & Poor’s, Factset)

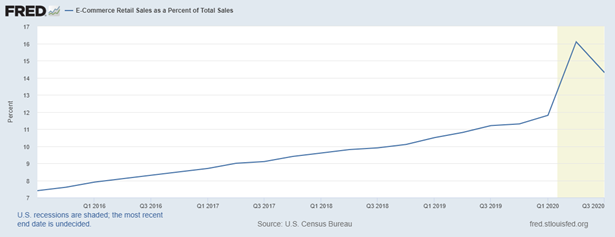

The ultimate winners in 2020 became known as the “stay at home” trade which predominantly consisted of internet-oriented businesses or cloud platform providers. As seen in Chart 3, E-Commerce sales had a crescendo from the 1st quarter into the 2nd quarter but abated as states began to re-open. While there were several winners in the Information Technology sector, due to sheer size and sector weight, Apple and Microsoft drove the sectors performance. Similarly, Amazon was predominantly responsible for the returns in the Consumer Discretionary sector. Finally, Facebook, Google, and Netflix drove the Communication Services sector. These companies shared a common thread of growth in an otherwise uncertain environment. Of those previously mentioned companies, only Apple and Microsoft pay a dividend, and we own both companies.

Chart 3

Source: Federal Reserve Economic Database

While the Information Technology sector led in 2020 it is important to note that the same sector was also the market leader for 2019 as well. Looking at Chart 4, it is rare for the same sector to win two years in row like technology did in 2019 and 2020. The chances for three years in a row appear to be quite small.

Chart 4

Source: Novel Investor

Doing fine with guidelines

Our primary goal is to identify companies positioned for continued dividend growth propelled by fundamentals that also support long-term capital appreciation. At the onset of our strategy, we established guidelines that established a foundation for a high conviction portfolio that maintains the broadest economic exposure possible. To achieve this goal our strategy guidelines mandate that we have exposure to all sectors. Also, to broaden exposure, we allocate our portfolio across a wide range of dividend yields, from low to high. Finally, we allocate to economically defensive businesses as well as more economically cyclical businesses. The result is that our collective portfolio targets higher than S&P 500 dividend growth and dividend yield while also positioning for lower volatility (beta). While these guidelines sometimes seem overly conservative, given the wide range of sector performance, this past year proved its value.

Most dividend strategies unduly focus on maximizing yield. Following that logic, several of our peers had portfolios that were likely tilted towards Financials, Real Estate, and to a lesser degree Energy. All three of these sectors were negative for the year and were the only negative sectors in the S&P 500. The conclusion is that while dividends matter, placing too much emphasis on dividend yield alone may lead to a less consistent portfolio with erratic performance. While we had some laggards in the higher yielding segment of our portfolio, our lowest yielding companies ended up being the drivers of our total return for the year, achieving the balance that we seek.

Outlook

We expect 2021 to see continued dividend growth in the mid-single digits. Wholesale dividend cuts have also appeared to have stabilized since May and share buybacks should resume for most companies in 2021. Select companies with quality characteristics should be able to continue both dividends and continue buybacks.

As the economy re-opens, we believe it is entirely reasonable to see some continued rotation towards cyclical value companies in the energy, financial, industrial, and materials sectors. The US dollar has not been this weak since 2018, especially relative to the Euro. In the fourth quarter we took weightings up on a few select industrial stocks that should not only benefit from a weak dollar but also from the potential for domestic infrastructure spending. The potential for a continued weak dollar also bodes well for emerging markets and US companies in the energy sector along with export-oriented businesses. We would also expect that the “stay at home” trade will begin to fade, along with the higher valuations that select beneficiary companies commanded. Along these lines company selection will be key within information technology, consumer staples, consumer discretionary, and utilities.

On the interest rate front, there is growing probability that rates could surprise on the upside. While the Fed has stated that a low interest policy is here until 2023, talks of tapering in the bond purchasing programs could unnerve some. Economically, as we see a cyclical rebound, there is potential for pressure on inflation measures which could also result in higher interest rates. Growth stocks have thrived in a low interest rate environment and cyclical stocks may finally have their day in the sun as earnings could surprise on the upside.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|