August and September have historically been the worst performing months for markets and this year was no different. The S&P 500, Dow Jones Industrials, and NASDAQ indexes declined 3.3%, 2.1%, and 3.9% respectively in the 3rd quarter of 2023. The backdrop for the 3rd quarter was highlighted by the 10-year Treasury trading at its highest yield since 2007. Oil prices also jumped 29% as production cuts by OPEC+ resulted in lower inventory levels. Adding to the tensions, a government shutdown was averted at the last hour while the US dollar quietly strengthened. The dollar’s 17 straight weeks of advancement marked the second longest streak in over 50 years.

Brentview’s Dividend Growth portfolio composite slightly underperformed the S&P 500 during the quarter. The strategy, however, was able to outperform the higher yield focused Dividend Aristocrats category. The Dividend Aristocrats index tends to emphasize slower growing businesses as the constituent companies are required to have raised their dividends for at least 25 straight years.

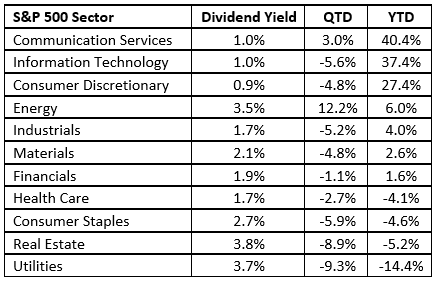

The sectors of the S&P 500 are shown in Table 1 in order of their year-to-date performance. While the first half of 2023 had been strong for Information Technology, the sector was down 5.6% for the 3rd quarter. This same sector had the largest detraction from the S&P 500 index returns based on its sheer size, a 28% index weighting. Technology companies with notably large index weights such as Apple and Microsoft were off 11.6% and 7.1% respectively. The worst sectors by returns for the quarter were Utilities, Real Estate, and Consumer Staples. While these sectors are all considered defensive, they are also interest rate sensitive. Additionally, with inflationary headwinds, these same sectors and industries have been impacted year to date as well. Companies within the Consumer Staples sector might be reluctant to raise prices too much, otherwise consumers might switch to store branded generics. In fact, in certain instances, staples companies have “taken back” price increases in the past. Staples companies in particular run the risk of seeing inflation from their cost of inputs, thereby squeezing operating margins, especially if the company is not able to pass on the rising costs via higher prices.

Table 1 (sorted by YTD performance)

Source: Factset Research

Not Your Father’s Dividend Market

Investors in the dividend segment tend to be conservative, risk averse, and focused on long-term results. However, as the Federal Reserve embarked on quantitative easing, finding yield became increasingly more important, with one of those benefactors being the utilities sector. As a “bond proxy” sector, utilities were seen by investors as a safe harbor to find yield with limited volatility, especially during a period of yield scarcity post quantitative easing. Late into the 3rd quarter, the Utilities sector saw a broad-based sell-off due to concerns related to rising treasury yields, and therefore, yield alternatives outside of that sector. With the Federal Reserve raising rates, the Utility Sector fell victim to “switching preferences” where yield seeking investor “tourists” left the sector in favor of other yielding vehicles.

In April, August, and early October of this year, our valued clients received our intra-quarter Brentview Dividend Digest commentaries. Understanding that the “set it and forget it” approach may not be the best way forward, our Dividend Digest has briefly covered current events around the Regional Banks, Semiconductor, and more recently the Utilities segment. While dividend yields are important, the related risks associated with each company and industry cannot be overlooked. Having exposure to the lower dividend yielding cohort has been essential for maintaining resilience with today’s economic crosscurrents, even though it may sound counterintuitive. Security selection, fundamental research, and having an allocation across the entire dividend opportunity set seems like a reasonable way forward.

The Year of the Worker

2023 has thematically become the Year of the Worker as measured by the number of strikes we have seen this year. The UAW is picketing in Michigan, the Writers Guild and Screen Actors Guild struck in Hollywood, culinary workers in Las Vegas joined the picket lines, and more recently health care workers at Kaiser Permanente walked off the job. These ongoing wage pressures will be a challenge for the Federal Reserve to reach its inflation target of 2%. The future labor supply is compounded by retiring baby boomers, restrictive immigration policies, and the ongoing Covid supply chain disruption. Like post World War 2, the 1940’s were a period marked by inflation which ebbed and flowed due to the disrupted and repairing supply chain. Similarly, we face matching dynamics due to temporary shortages, work stoppages, and suboptimal supply chains as some companies opt for on or nearshoring.

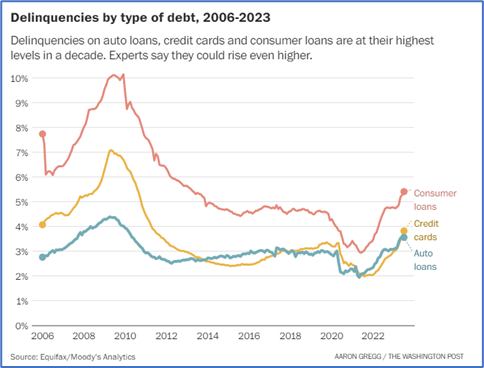

Nonetheless, the economy has been resilient despite pundits’ calls for a recession over a year ago. Last year, technology companies went through a period of layoffs as enterprise spending slowed, though the consumer remained resilient. However, as seen in Chart 1, signs are now emerging that the consumer is becoming strained. Delinquencies and defaults on credit cards have ticked up, gasoline prices have surpassed $5 in several parts of the US, and food companies continue to raise prices above the rate of inflation. Although the Federal Reserve’s preferred measure looks at core inflation (ex-energy and food), these combined factors are stretching the consumer’s wallet.

Chart 1

Corporate earnings are estimated to be down 0.2% in the 3rd quarter, which marks the 4th straight quarter of year-over-year declines. Earnings estimates for the 4th quarter and full-year 2024 call for 8.6% and 12.2% growth respectively, and these estimates will be challenged if a recession occurs. Additionally, a strong dollar may continue to weigh on multinational companies with significant ex-US revenues. The current forward P/E for the S&P 500 is 18x versus a five-year average is 18.7x and a 10-year average is 17.5x. Faster growing segments, like the technology sector, are trading at 24x projected next 12-month earnings. The overall challenge for the market is having the “risk free” treasury yielding 5%, a level not seen in 16 years.

So, if a “low volatility” portfolio is your preference, what is defensive position nowadays? Utility stocks are down over 14% in the first 9 months of the year while Real Estate Investment Trusts and Consumer Staples have fared slightly better but are still off about 5%. Consumer Staples have benefited from price increases that have outpaced inflation since covid. However, future price increases are likely to be muted as volumes have declined and trading down to store branded options remains.

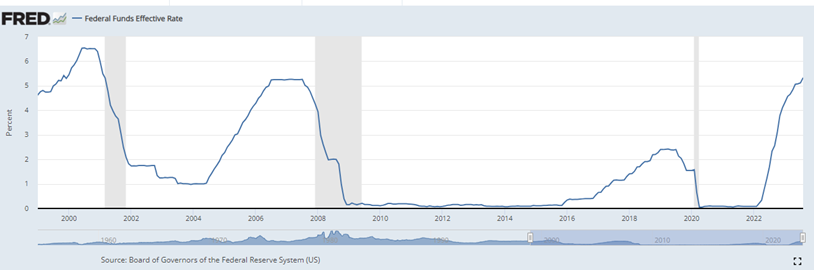

As seen in Chart 2, the last three recessions were preceded by sharp increases in interest rates. Past rate hike regimes were not as steep and fast as the current spike in interest rates. A decade of near-zero interest rates and quantitative easing has made it seem as though the business cycle is over, but the economy has remained resilient.

Chart 2

Source: Federal Reserve Economic Database

Dividend Growth Scorecard

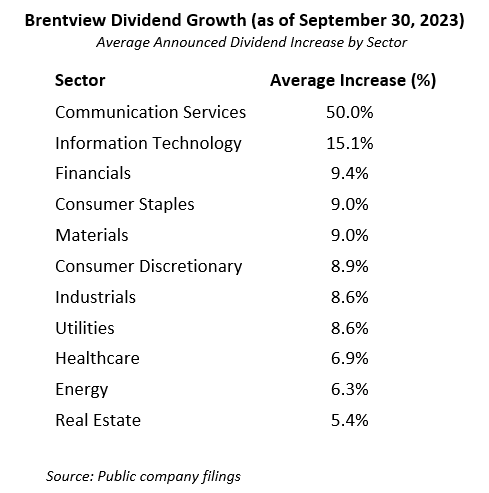

According to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, in 3Q 2023, the cumulative dollar value of U.S. common stock dividends per share posted a 6.1% increase for the trailing twelve months1. Year to date, thirty of our thirty-six holdings (86%) have announced dividend increases of 11% on average through September 30th.

As seen in Table 2, on a year-to-date basis, all eleven GICS sectors have seen a dividend increase through September 30th. During the quarter we saw seven holdings announce dividend increases. Financial sector holding Marsh & McLennan announced a 20% dividend increase, which was a significant improvement on their 10% dividend increase from last year. Otherwise, the Information Technology and Staples sectors collectively saw the most dividend announcement activity during the quarter. More notably, the average dividend increase within the Information Technology sector was 13.7% this quarter and has served our strategy well for finding faster dividend growers overall.

Table 2

How is Brentview positioning our portfolios?

At Brentview, we frequently evaluate our companies to determine if we should continue holding, especially when the dividend growth rate has slowed. This “maintenance research” is essential and ongoing to ensure that we own businesses which still match our original thesis. In this instance, our two sales this quarter were related to slowing dividend growth rates and deterioration of end markets. As a result, we lowered our REIT weightings as some industry sub-sectors remain challenged. We also swapped our semiconductor exposure towards end markets where more compelling volumes and growth rates can be found. Related to Johnson & Johnson, we passed on the Kenvue spinout, despite the tantalizing high dividend yield. Ultimately, we were concerned with the future growth prospects of the spun-out business. The portfolio managers at Brentview have been actively positioning our portfolio towards lower yielders with more attractive fundamentals. Our six outright sales in 2023 had an average dividend yield of 3.8% while our three new purchases this year had an average dividend yield of 2.2%.

With this potential “higher for longer” interest rate environment, stock selection has become even more imperative than blanket sector calls. Along those lines we prefer companies that are self-financing and have strong cash flows. When selecting companies, especially in today’s environment, businesses that demonstrate strong unit growth are viewed very positively vs. companies that are growing revenues solely from price increases.

Sources

1 Press Release dated October 4, 2023

Prnewswire com/news-releases/sp-dow-jones-indices-reports-us-common-indicated-dividend-payments-increase-8-8-billion-in-q3-2023--as-the-12-month-gains-37-5-billion-301947134.html

This commentary reflects the views of Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|