The third quarter of 2020 was a strong quarter with the S&P 500 up 8.5%. While the quarter began with a bang, it seemed to end with a whimper as the month of September sold off by 3.9%. Despite the September weakness, the Nasdaq Composite was still able to post an 11% appreciation for the third quarter.

The gains in the third quarter, combined with the strong second quarter, marked the best two quarter period since 2009. During this same time frame the IPO market was especially strong with technology stocks getting most of the interest.

Growth stocks drove the market returns, especially technology darlings like Apple and Tesla, while homebuilders surged on strong demand driven by low mortgage rates. The leading industry sectors were technology, materials, industrials, and some retailers. Energy was the worst sector off 20%, representing the only negative industry group.

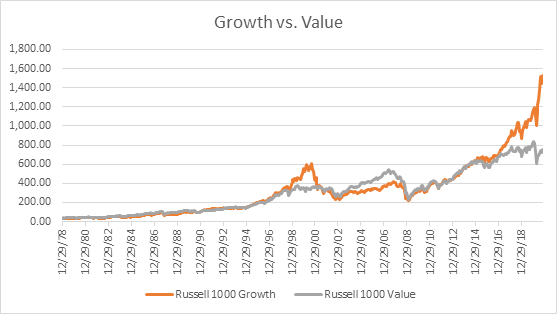

The chart in exhibit 1 shows that growth stocks have not been this popular since the late 1990’s before the bubble burst for technology stocks in 2000. Echoing the 2000’s timeframe, value stocks have lagged growth stocks for several years and by a wide margin. Even more poignant is the fact that earnings estimates were down 33% in Q2 2020 with energy stock estimates lowered by 105%, as most companies removed their forward guidance.

Exhibit 1

Source: Factset Research

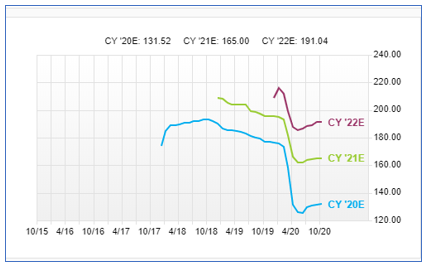

Once companies began reporting, more than 80% beat earnings expectations and 59% beat revenues estimates. Since then, earnings estimates have slowly been rising as seen in exhibit 2.

Exhibit 2

Source: Factset Research

From a valuation perspective the S&P 500 currently trades at 21x 2021 earnings and 18x 2022 earnings estimates. Many analysts view 2022 as a normalized earnings year post COVID. We believe many companies, particularly in the leisure and entertainment sectors, will have a difficult time achieving these lofty estimates.

Dividends, 2020 style

Much like the day to day routines of old, the dividend landscape has changed in 2020. This year has brought around a dynamic where dividend payments are being reduced, and reductions have not been at this level since the 2008 financial crisis. However, during the 2008 timeframe the pain from dividend cuts were predominantly felt within financials.

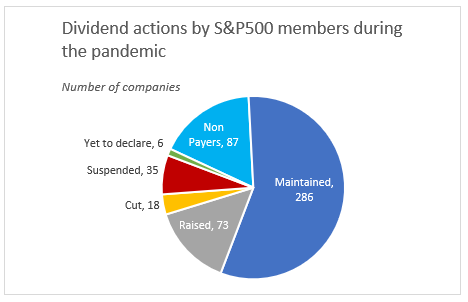

What is unique and different this year is that dividend suspensions have outpaced outright dividends cuts as seen in exhibit 3. Additionally, the industries affected in 2020 have also changed. Today, travel, entertainment, retailing, restaurants, and energy stocks are the main industries that cut or omitted dividends. Company size also did not matter. Large bellwether companies were not immune as Boeing, Disney, and Delta Airlines all suspended dividend payments to name a few. Conversely our dividend growth strategy has seen more than half of the holdings raise their dividends, during the pandemic period, compared to only fifteen percent of companies in the S&P 500. Most companies have maintained their dividends during this timeframe.

Exhibit 3

Source: JP Morgan Quantitative and Derivative Strategy

Brentview’s investment outlook anticipates lower interest rates through 2023 as the Federal Reserve remains on hold while the economic recovery gains traction. We do expect some market rotation into select value stocks as the gap between value and growth narrows, however, we would be cautious against tilting entirely towards value.

Among the key near term events, the elections are expected to provide some uncertainty. However, regardless of who is in power in 2021, the biggest certainty is that some form of economic stimulus is in the cards. Other areas to watch include select large technology companies as they may also face anti-trust scrutiny. Depending on the election outcome, infrastructure stimulus would benefit more cyclical parts of the economy.

We have strived to enhance the dividend growth rates for our portfolio as the uncertain economic environment provides an opportunity to widen the gap versus our peers and the index. Today’s timeframe seems akin to 2008-2009 when our portfolios had positive dividend growth and the market was still negative. We also are on the lookout for companies that have transformed themselves as the pandemic may have permanently changed how some industries operate. We will continue to evaluate these changes and modify our holdings accordingly.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|