In the third quarter, our strategy outperformed the S&P500, our primary index, on a gross and preliminary basis by 330 basis points, returning 5% vs. 1.7% for the index. Year to date, again on a gross and preliminary basis our strategy is outperforming the index by 400 basis points, returning 24.6% vs. 20.6% for the index. With the recent shifts in valuation Brentview’s dividend growth portfolio positioned itself to take advantage of the current market environment. We trimmed select positions within communications services and real estate that had recently outperformed. In addition, we increased our health care weighting by adding a new position that has an attractive dividend yield but also exposure to the pharmaceutical and biotech industries.

Summary:

- On a gross and preliminary basis our strategy outperformed the S&P500, our primary index.

- This past quarter saw a quick change in tone as the S&P500 index hit new highs in July but then subsequently weakened in both August and September driven by trade tensions and geopolitical events.

- Q3 earnings are now estimated to decline 3.7% and are on pace for a third straight quarterly decline. The last time the S&P 500 experienced three straight quarters of earnings decline was back in Q4 2015.

- Defensive “bond proxy” sectors like Utilities, Real Estate and Staples were among the stronger performers.

- Clearly investors have a lot of items to contemplate. Aside from quickly changing risk preferences and outlook for interest rates, the fundamental backdrop for corporate earnings is becoming increasingly company specific.

- The importance of stock selection will continue to grow as each company’s balance sheet strength gains additional scrutiny from investors.

For the 1st 9 months of 2019, the S&P500 was off to its best start since 1997. For the third quarter, however, the S&P 500 index eked out a 1.7% total return gain. This past quarter saw a quick change in tone as the S&P500 index hit new highs in July but then subsequently weakened in both August and September driven by trade tensions and geopolitical events. An interesting shift occurred in the month of September when investors fled momentum growth stocks for value-oriented areas such as the financial and energy sectors.

During the quarter a quick review of the S&P500 index found that almost half of the holdings had negative total returns. The once highflyer Netflix was off 29% during the quarter as streaming competition emerged from both Disney’s Plus subscription service and Apple’s TV offering. Additionally, the Energy sector performed the worst, despite a spike in oil prices, after an attack on Saudi Arabia’s energy infrastructure. Finally, the continued trade tensions took center stage as investors weighed the potential for an escalating trade war and rising tariffs, which especially impacted companies with exposure to China.

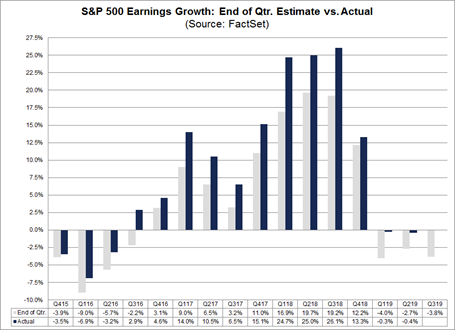

The US dollar index was up 3.51% and hit a yearly high in the third quarter, which does not bode well for corporate earnings. In fact, earnings estimates for the S&P 500 continue to ratchet lower. When looking across the various sectors the earnings estimates for the energy, technology, financials, and industrials sectors are coming down the fastest. Q3 earnings are now estimated to decline 3.8% and are on pace for a third straight quarterly decline. The last time the S&P 500 experienced three straight quarters of earnings decline was back in Q4 2015 as seen in Chart 1.

Chart 1. S&P500 Estimated Earnings Growth through 3Q19

Source: Factset Earnings Insight

Despite all the concerns that manifested it is not surprising that defensive “bond proxy” sectors like utilities, real estate and staples were among the stronger performers. Aside from the shift away from cyclically oriented sectors, a decline in interest rates propelled these bond proxy sectors and long maturity treasuries as seen in Chart 2.

Chart 2. 30 Year Treasury Yield (through 9/30/19)

Source: Factset data services

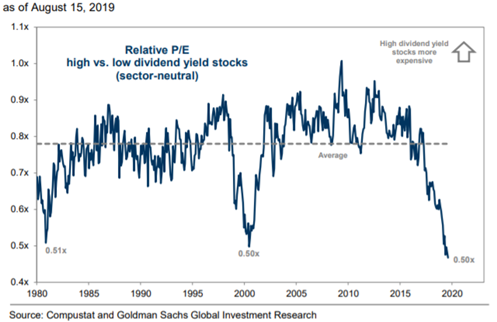

Clearly investors have a lot of items to contemplate. Aside from quickly changing risk preferences and outlook for interest rates, the fundamental backdrop for corporate earnings is becoming increasingly company specific. As dividend growth managers we think the chart above is an interesting phenomenon. High dividend yielding stocks are at their lowest valuations in 40 years. Our investment team recently screened this universe to uncover attractive opportunities. At this present time, because of the valuation backdrop, we are increasingly focused on companies that fall into this higher yield segment that also possess low valuations and the potential to grow their dividend as seen in Chart 3.

Chart 3. High dividend yield stocks trade at lowest valuation in 40 years

The environment for dividend increases continues to reward patient investors. Of the 40 current holdings that we have, 9 companies announced dividend increases this past quarter. The largest increase was seen by PNC Financial, which announced a 21.1% increase. Conversely the smallest increase was seen by Philip Morris, which raised its dividend by 2.6%. For the quarter the Dividend Growth portfolio saw an average increase of 11.3% vs. an average increase of 10% for the S&P500 Index.

Our positioning remains cautious on the near-term market outlook, especially given the huge year-to-date returns of the S&P500 index, despite the backdrop of a slowing global economy. We believe that lower interest rates were a key driver for stock market returns in 2019. The importance of stock selection will continue to grow as each company’s balance sheet strength gains additional scrutiny from investors.

While this topic has received some press coverage, we remain concerned about the growing levels of corporate debt and have been mindful when selecting companies for our portfolio. Consumer balance sheets, however, still appear to be in good condition. Despite lots of headlines and concerns, we do not see a recession occurring during an election year. Nonetheless, we are currently evaluating and determining which sectors are most vulnerable when the next recession inevitably occurs.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss.