The stock market measured by the S&P 500 was up 8.3% for the 2nd quarter. This return now represents three straight positive quarters in a row. The Nasdaq 100 posted its best first half since 1983, returning a positive 31.7%. The market returns have defied expectations with some prominent market strategists calling for a 20% market correction. Over the past year, investors have shaken off rising interest rates, an inverted yield curve, and persistent calls for a recession. Even with the S&P 500 valuations near 19x earnings, equity investors generally remain unfazed.

Investment return characteristics in the second quarter were very similar to the first quarter. Artificial Intelligence was the common thread among the market leaders, even though breadth remained narrow and large cap returns were derived from seven mega cap growth stocks. Dividend paying stocks (ex-Apple and Microsoft) continued to lag the overall market. Apple closed the quarter with a $3 trillion dollar market capitalization and representation equal to almost half of Berkshire Hathaway’s portfolio.

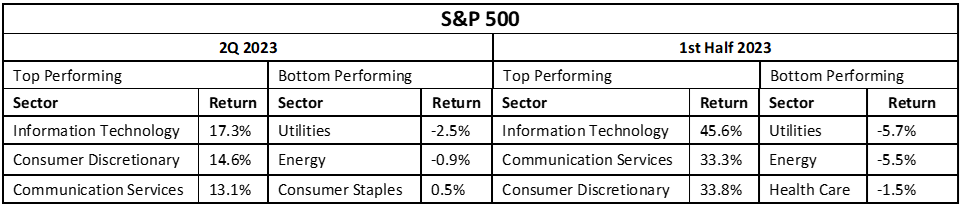

Given the leadership from non-payers during the quarter, Brentview Dividend Growth underperformed the S&P 500, our primary index. However, our strategy outperformed most dividend-oriented managers as our balanced approach invests across the dividend yield spectrum, capturing opportunities typically missed by dividend managers focused on maximizing yield. As seen in Table 1, the defensive and higher yielding segments such as utilities, health care, and staples have lagged the overall market regardless of timeframe in 2023. The month of June saw the S&P 500 index broaden out towards the industrial and materials sectors, which have not led up until this point. Small cap equities, as measured by the Russell 2000, rose 8% in June, exceeding the S&P 500 return of 6.6%. Midcap equities, as measured by the S&P 400, did even better and returned 9% for the month. All said, it’s encouraging to see the breadth of performance spreading out in both sectors and market capitalization.

Table 1

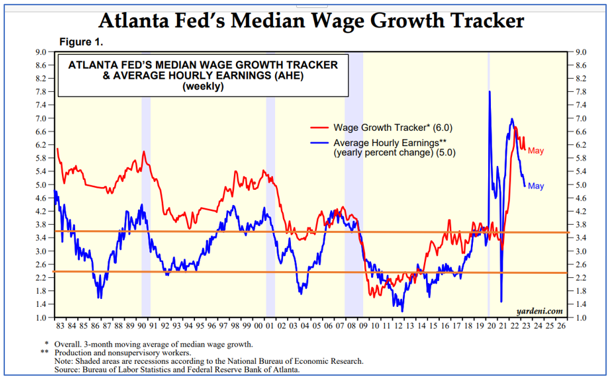

Even with all the pundits talking about a looming recession over the last 12 months, the economy has remained resilient. The consumer has tilted their spending away from goods and into services or experiences. We have seen progress on the inflation front particularly as it relates to goods, however, service inflation remains stickier. Even more challenging is wage growth as seen in Chart 1. The Federal Reserve wants to get wage growth back to the 2.5% to 3.5% range. This target might require higher interest rates for longer before it even has an impact.

Chart 1

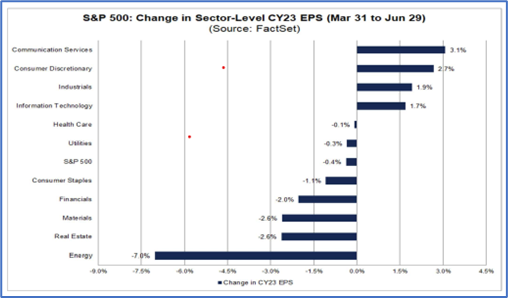

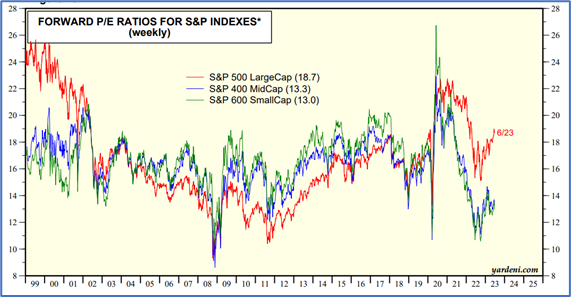

The 2nd quarter 2023 earnings for the S&P 500 are expected to decline 6.8%. This represents the third straight quarterly decline and largest drop since Q2 2020 when earnings fell off 31.7%. For the calendar year 2023, the Energy, Real Estate and Materials sectors are expected to have the largest decline in earnings as seen in Chart 2. The Communication Services, Consumer Discretionary, and Industrials sectors are expected to fare the best. As seen in Chart 3, the current valuation for the S&P 500 is 18.7x on a forward 12-month basis. This is above the five and the 10-year averages of 18.6x and 17.4x respectively. Conversely the mid and small capitalizations are currently trading near 13x, which is and not too far off their 2008-2009 bottom.

Chart 2

Source: Factset Research

Chart 3

Source: IBES data by Refinitiv

Dividend Growth Scorecard

According to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, in 2Q 2023, the cumulative dollar value of U.S. common stock dividends posted a 6.3% increase for the trailing twelve months1. Contrasted to our strategy, for the holdings in our portfolio, the average increase was 9.9% for the same period. Year to date, eighteen of our thirty-six holdings (50%) have announced dividend increases of 11% on average through June 30th. Brentview Dividend Growth’s positioning in the first half of 2023 was primarily designed to enhance the overall dividend growth rates of the portfolio.

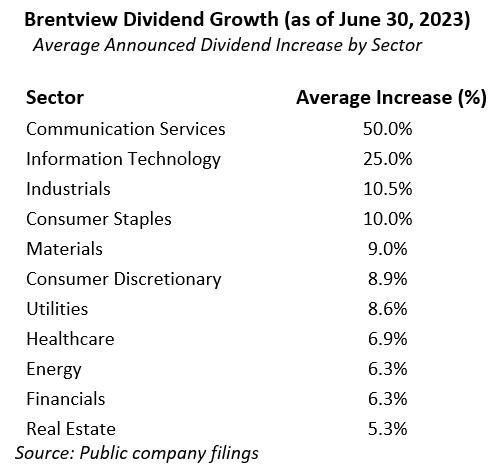

As seen in Table 2, our portfolio saw holdings across all eleven GICS sectors with a dividend increase. The Communication Services sector has remained at the top with the largest announced average dividend increase during the year. The Industrials and Heath Care sectors saw the most dividend announcement activity during the quarter.

Table 2

How is Brentview positioning our portfolios?

2022 was an unusually quiet year for buys and sells. Historically our turnover has ranged 15-30% per annum. However, last year we were below our typical range, which turned out to be the right call. This year, the activity has picked up as we’re seeing potential business risks, due to inflation. We are also seeing some opportunities due to shifting consumer behavior and valuations overall.

Since the start of 2023 we sold a consumer staples position that had weak volume growth from price hikes and it also experienced rising input costs. The company’s dividend growth had slowed from double digit to single digit. Similarly, we sold an industrial position that saw its 10% dividend growth rate slow to 2%. The company’s end markets weren’t aligned well with the government’s infrastructure spending program. During the 2nd quarter we sold out of our regional bank position as we foresee increased regulations and higher capital requirements resulting in slower dividend growth for this group. We also sold a health care holding that appears to have some downside due to business mix from their existing product line and future pipeline development. In addition, we added a consumer staples business that we believe not only exhibits consistent growth but also possesses a superb balance sheet. Finally, we took advantage of the weakness in the Real Estate sector to add a new position with a market leader with mid-single digit dividend growth rates and an attractive yield. Our recent portfolio adds to existing holdings centered on companies that would benefit from a re-opening of the economy post pandemic. Despite these more recent moves, our turnover stands at 17.2% for the trailing twelve months.

One thing to note is that Special dividends will become a larger component of income at Brentview. Some of the positions in our portfolio have instituted a reliable history of paying special dividends. For this reason, our stated portfolio yield does not incorporate special dividends and is understated.

Our market outlook anticipates that sector returns will continue to further broaden out during the 2nd half of 2023. As a result, dividend paying equities should perform better as the year progresses. Returns for dividend paying equities in the first half of the year were up only 4% versus 18% for non-dividend paying companies. Recent flows into equal weighted and small-midcap ETFs should also support this trend away from the mega cap, non-dividend paying segment. The markets above average valuation is dominated by a few mega cap companies. Moreover, small-to-mid cap equities have lower valuations than their large cap brethren. For this reason, we continue to hold some midcap positions that possess good dividend growth and we believe are undervalued.

Sources

1 Press Release dated July 5, 2023

Prnewswire com/news-releases/sp-dow-jones-indices-reports-us-common-indicated-dividend-payments-increases-slow-to-4-3-billion-during-q2-2023-12-month-gain-was-46-3-billion-301870370.html

This commentary reflects the views of Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|