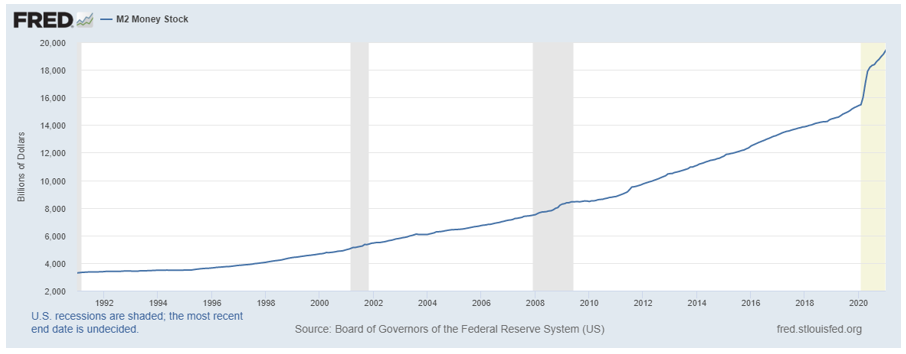

Economic growth is expected to reach 7% in 2021, the highest increase since the Reagan administration’s 1984 expansionary period. Massive government stimulus and an accommodative Federal Reserve have underpinned these expectations. As seen in Chart 2, the M2 money supply shows the substantial upward spike since 2020.

Is Inflation Transitory?

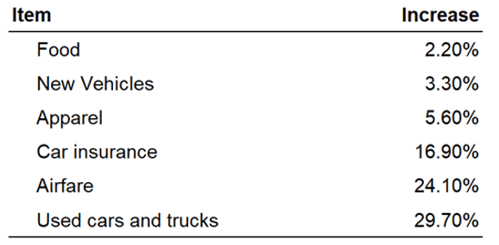

As inflation continues to spike, Fed officials have often used the term transitory to calm markets. Table 1 shows the major contributors, with used cars leading the way. Government measured CPI Index inflation rates jumped 5% from May 2020 to May 2021, the largest increase since 2008.

A semiconductor shortage has slowed the production of new vehicles, which in turn has driven up prices of used autos. Moreover, rental car companies have been purchasing used vehicles as well to fill demand as travel and tourism picks up. Despite the outsized increase in prices recently, independent auto industry consultant Maryann Keller says, “This won’t last forever…Things will get back to normal.”

Table 1

CPI Index: Changes in price (May 2020 to May 2021)

Source: Bureau of Labor Statistics

Rising commodity prices have also contributed to increased inflation. The Commodity Research Bureau’s Commodities Index is up 25% through 2Q21, though we are starting to see some commodity prices peak. For example, lumber prices have dropped 37% in the most recent month.

A major concern right now is whether inflation will impact wages. There are indicators that several hourly wage type jobs are seeing increases. However, it is less clear if that is happening with enough breadth to have an economic impact. Currently, there is a labor shortage being experienced due to the combination of early retirement and potential workers delaying entry into the workforce due to COVID fears. This shortage has put an upward price on wages. While not as volatile as commodities, a change in wages is significantly “stickier” than commodity price changes. Visually, the oft used metaphor is that wage inflation is akin to putting toothpaste back in the tube.

Despite these cross currents, the Federal Reserve maintains that inflation will be transitory due to the base effect and maintains a view that price increases are temporary. The economy is lapping price levels of the most extreme period of the pandemic. Additional datapoints will determine the duration and impact of inflationary pressures.

Regarding inflation, dividend growth, as a factor, has historically been well suited for an inflationary environment. Reason being is that companies that demonstrate consistent dividend growth tend to be businesses that have historically shown strong cost controls. This discipline maintains or potentially expands margins over time as weaker competitors subside. Companies with these types of attributes also tend to be market leaders, which are price makers as opposed to being price takers.

Our strategy has consistently employed a wide range of dividend yields by design which also exposes the portfolio to wide range of dividend growth rates. Should the inflationary pressures continue, our dividend growth segment of companies should be able to equally increase prices and maintain margins all things being equal. Conversely a portfolio solely focused on maximizing dividend yield, which may be more reliant on slower growing businesses, may not fare as well on a relative basis.

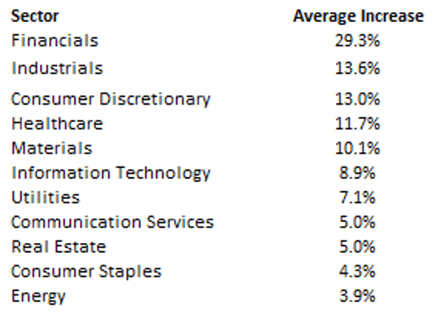

Already in the first half of 2021 the Brentview Dividend Growth Strategy has seen fifty three percent of our current holdings announce dividend increases. As seen in Table 2, Financials have led all the eleven S&P sectors with the fastest growth, which makes sense after being stagnant for a couple years. Both the pace of increases and breadth across all sectors have been very encouraging. The rate of announced dividend increases over last year has been even more impressive.

The average year over year announced increase of dividend payments in our portfolio currently stands at 13.3% through the second quarter. During this same timeframe, according to S&P analyst, Howard Silverblatt, the broader S&P 500 market has achieved 5% cash dividend payment growth.

Table 2

Brentview Dividend Growth (as of June 30, 2021)

Average Announced Dividend Increase by Sector

Source: Public company filings

Is the Value Rotation Over?

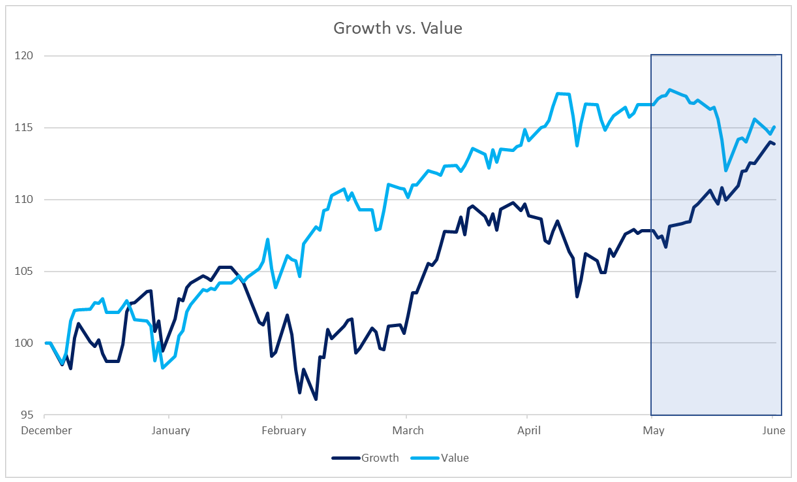

Although value has won year-to-date, as seen in Chart 3, growth stocks posted a huge turnaround in the month of June, beating value by the most in 20 years as highlighted in the shaded area. It is likely that interest rates will rise sooner rather than later, boding well for the Financials sector, which makes up 20% of the Russell 1000 Value Index.

Chart 3 Source: Factset

Source: Factset

In addition, we believe infrastructure spending will bolster cyclicals in the Industrial sector. Information Technology companies have demonstrated low-beta characteristics in recent years, providing more downside resilience than prior periods, including the oft-volatile semiconductor industry. In light of these current dynamics, the Brentview Dividend Growth Strategy is currently overweight Industrials and Financials and underweight Information Technology versus our primary benchmark the S&P 500.

Taper Tantrum 2.0?

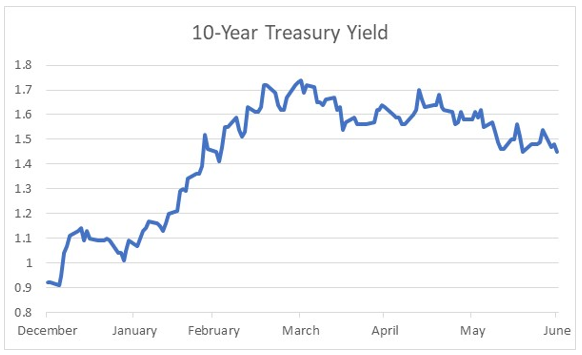

Interest rates have perplexed investors in 2020. Despite rising rapidly to start the year, the 10-year has stabilized and began to trickle lower as seen in Chart 4.

The combination of limited Treasury issuance and the perception that peak GDP growth has already occurred, could be factors holding rates steady. A suspected “taper tantrum 2.0” does not seem to be moving markets despite indications that it is soon coming. The Fed has already stopped its purchases of municipal bonds and mortgage-backed securities and treasuries will follow.

Chart 4

Source: FactSet

Outlook

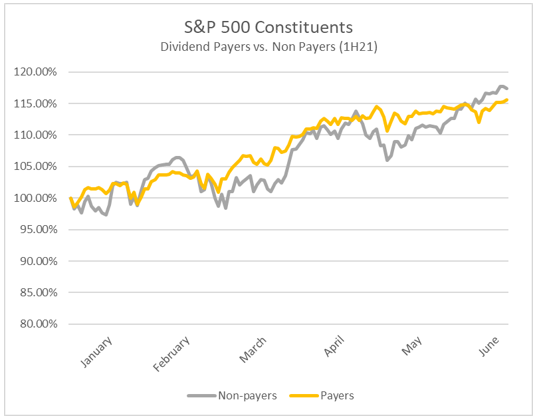

Dividend-paying stocks tend to skew more towards the value-oriented segment. As value outperformed growth in the beginning of the year, dividend-paying stocks outperformed non-paying stocks. The recent rebound in growth stocks created a difficult environment for dividend payers as some of the largest stocks in the index are non-payers.

After two years of almost no growth and following the recent Fed stress test results, bank stocks have responded with large dividend hikes as high as 100%. Industrial companies are also expected to exhibit above-average dividend growth as the industry resumes payments sooner than others.

Our recent portfolio changes were designed to enhance overall portfolio dividend growth and stay the course with our investment process. Our process provides flexibility to consider the broadest range of dividend payers by yield and growth rates. In addition, our mandate for including all sectors should also broaden out our exposure. Maintaining a focus on identifying companies with pricing power might be time well spent, regardless of the potential growth to value shift.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|