The first quarter of 2023 equity returns surprised most investors as the stock market shook off a regional banking crisis and rising interest rates. The S&P 500 index posted solid returns of over 7% which followed another strong quarter in Q4 of 2022. The tech heavy Nasdaq Composite climbed nearly 17% during the quarter. The S&P 500 posted its best mark since January 2019 and the Nasdaq Composite had its best start to a year since 2001.

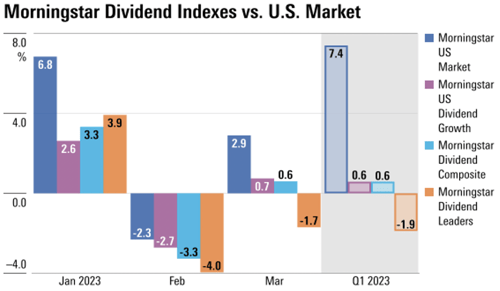

Dividend paying stocks underperformed the S&P 500 index during the quarter as did the Brentview Dividend Growth strategy. While our style was out of favor, our quarterly results compared favorability to our dividend-oriented peer group of active managers, especially those focused solely on yield. As seen in Chart 1, the top one hundred consistently paying high yielding stocks measured by the Morningstar Dividend Leaders index fell by 1.9%. While the Morningstar cohort US Dividend Growth index gained 0.6%, carried by Apple and Microsoft.

Chart 1

Source: Morningstar Direct, Morningstar Indexes. Data as of March 31, 2023

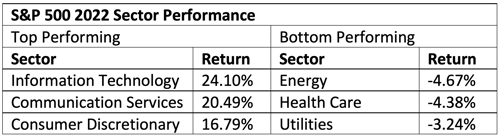

What was especially surprising was the composition of those returns. Value stocks just finished having a good year in 2022 which suggested that value stocks might finally make a run after being trounced by growth stocks for several years. What sectors worked in the first quarter? As seen in Table 1, Information Technology surprised most investors and led all sectors overall. The returns in the index were driven primarily by eight companies: Apple, Microsoft, Nvidia, Tesla, Meta, Google, Amazon, and Netflix. The remaining index constituents only attributed 17% of the first quarter returns.

Despite concerns about consumer strength and a looming recession, the Discretionary sector rounded out the top three sectors and appreciated by 16.8%. The worst performing sector was Energy, which declined by 4.7%. Following a strong 2022, the energy sector took on some of the brunt of economic growth concerns.

Table 1

Brentview owns a good percentage of core and growth stocks that helped us beat the Morningstar Dividend Growth index by 200 basis points. A key driver was our information technology weightings comprised of the subsector’s software, hardware, and semiconductors. Also contributing was our financials exposure which eked out a positive gain versus negative returns for the index’s Financials sector. Our diversification across seven different subsectors in Financials amounted to a 74% weighting outside banking, which mitigated risk during the regional banking crisis.

Growth stocks are long duration assets and normally do well in low interest rate environments. That is not the situation now as the Federal Reserve has rapidly hiked rates to slow down inflation. The growth rally was driven by investors looking forward and anticipating that interest rates may be peaking with even the possibility of rate cuts on the horizon. The Fed is adamant about beating inflation and has not hinted of a pause, let alone a rate cut.

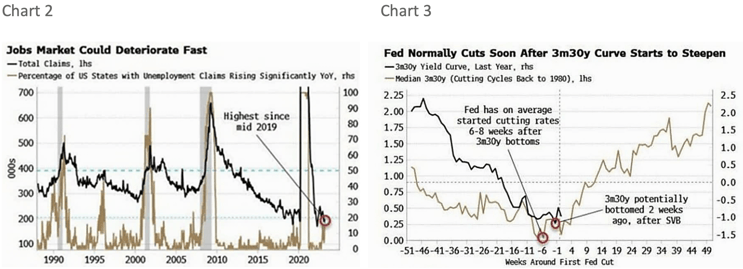

What would cause the Federal Reserve to pivot? If the economy declines rapidly, the Fed would likely blink. As seen in Chart 2, jobless claims are up 25% in a fifth of the states. Also, company layoffs are broadening from the technology and financial sectors into other industries. A negative payrolls growth figure could cause the policy makers to pivot.

The bond market is also flashing a recession warning as seen in Chart 3. The Federal Reserve usually cuts interest rates when the 3 month and 30-year Treasury curve begins to steepen. This may have occurred after the Silicon Valley Bank crisis.

Source: Bloomberg

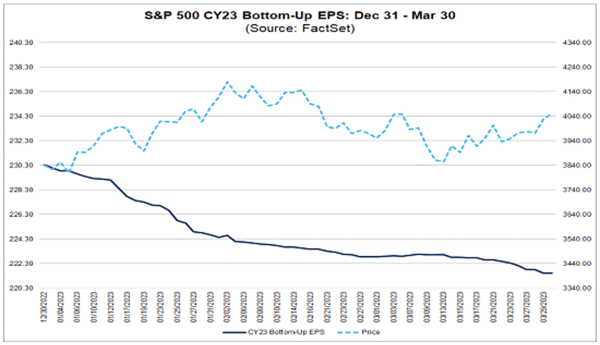

Ultimately the likelihood of an earnings recession is increasing, and it may finally be coming. Despite a long delay, wall street analysts began to take down their estimates more recently as seen in Chart 4. Even while earnings estimates were ratcheted downwards, the stock market has held up reasonably well. An earnings recession isn’t the same as an economic recession as profits can fall without the economy tumbling. In 2015-2016, earnings fell for 5 quarters in a row due to a global slowdown with the bull market not missing a beat.

Chart 4

Source: Factset Research

Dividend Growth Scorecard

According to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, in 1Q 2023, the cumulative dollar value of U.S. common stock dividend increases posted a 28.8% decline for the trailing twelve months1. Total U.S. common stock dividend increases equaled $19.7 billion in notional value vs. $27.7 billion in 1Q 2022. Contrasted to our strategy, fourteen of our thirty-eight holdings (37%) announced dividend increases of 12% on average through March 31st.

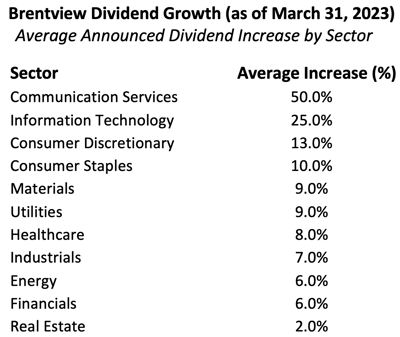

As seen in Table 2, our portfolio saw holdings across all eleven GICS sectors with a dividend increase. The Communication Services sector saw the largest announced average dividend increase during the year. It’s important to note that the largest dividend increase in 2023 came from one of our mid-cap companies that was “flying under the radar”, as mentioned last quarter. We continue to look for additional unique opportunities that are overlooked by our generalist peer group. Conversely the Real Estate sector saw the slowest dividend increase over the last year, but this sector also tends to offer better than market dividend yields. With looming recession concerns, economic growth slowdown, banking jitters, and resilient inflation, what is an investor to do? Historically, having all sectors represented, along with a broad representation across the dividend yield spectrum, has served our strategy’s consistency well. Our portfolio by design is crafted to outpace inflation with dividends growing faster than the current inflation rate.

Table 2

How is Brentview positioning our portfolios?

During the quarter we made a few adjustments within our portfolio. We took the opportunity to selectively add to our active weights of existing holdings within health care, staples, and financials. We trimmed two positions, which had a nice run of outperformance, within industrials and consumer discretionary. One staple position was sold out of the strategy as the inflationary environment began to meaningfully impact margins. As the business landscape continues to evolve, we routinely evaluate both prospective and existing holdings. Our focus remains on finding new dividend growth candidates at reasonable valuations. With the overall stock market trading at 18.1x forward earnings it becomes more challenging. We are seeing select opportunities in consumer discretionary, industrials, and real estate investment trusts. Several of these reside in the smaller to mid-cap space where valuations are more attractive, around 13x forward earnings.

Sources

1 Press Release dated April 4, 2023

Prnewswire com/news-releases/sp-dow-jones-indices-reports-us-common-indicated-dividend-payments-increased-9-7-billion-during-q1-2023-12-month-gain-was-59-7-billion-301789426.html

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|