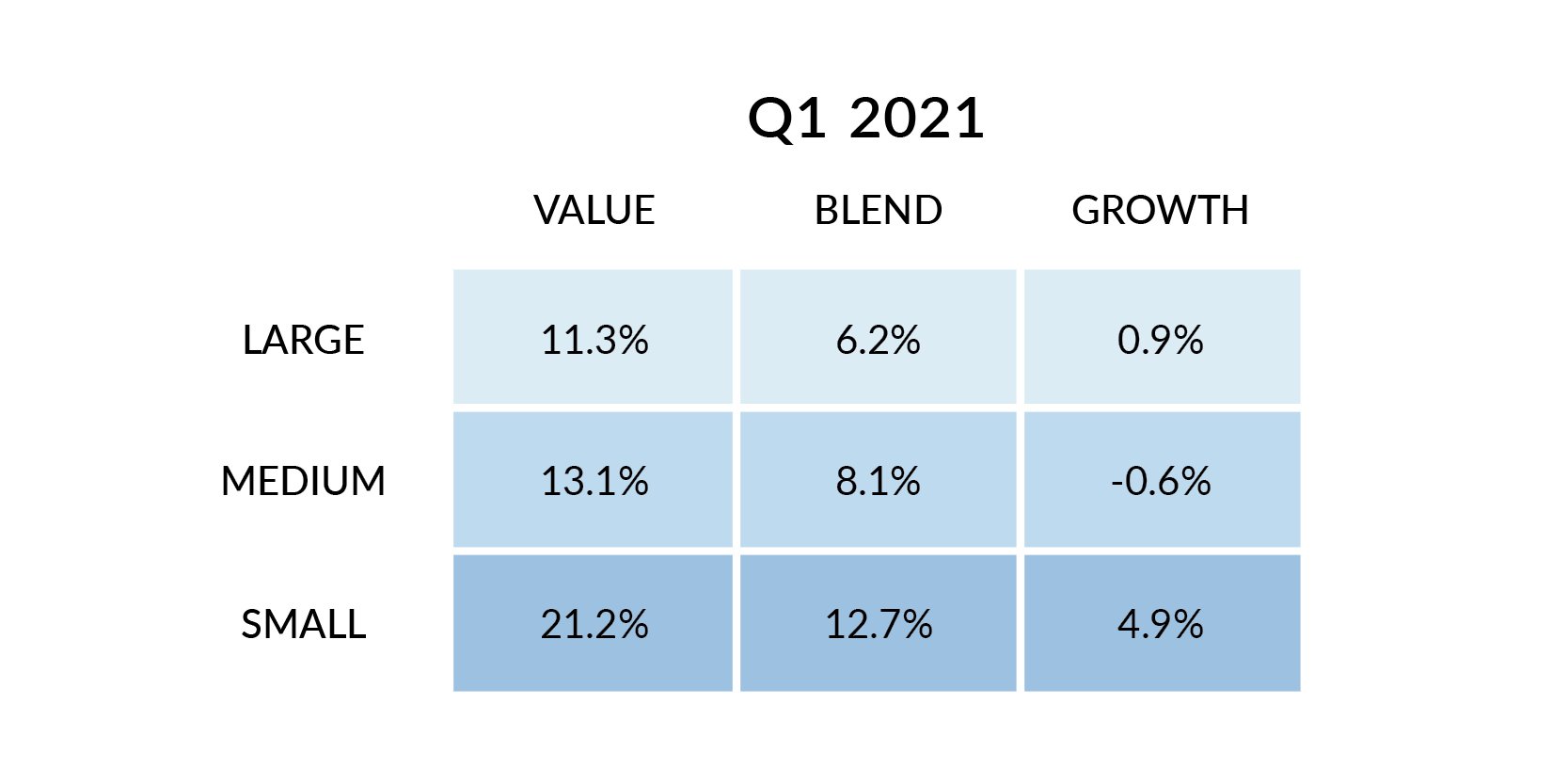

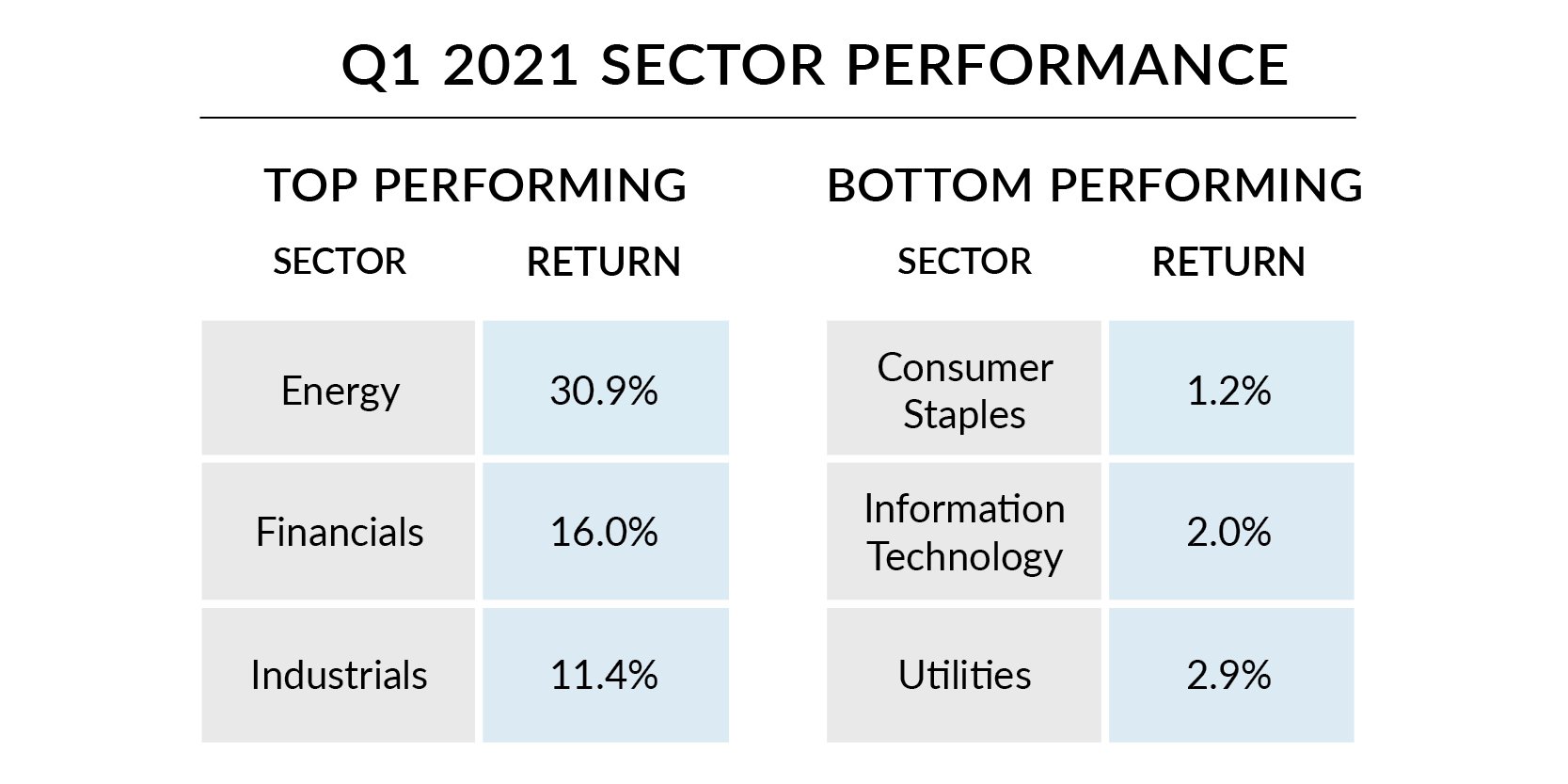

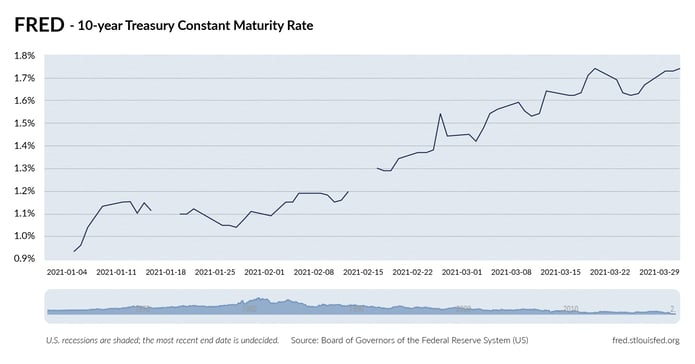

During the quarter equity markets saw a spike in volatility as the re-opening economy and fiscal stimulus package approved by Congress caused interest rates to quickly climb on heightened inflation expectations. The 10-year Treasury yield rose 83 basis points (chart 1) during the quarter, the largest increase since 2016. Defensive sectors such as consumer staples and utilities lagged the broader market. Considering this environment, investors continued to favor select value-oriented companies versus growth companies as evidenced by the fact that the technology heavy Nasdaq 100 eked out a 1.8% gain, which lagged the S&P500.

What a difference a year makes!

One year ago, the dividend landscape took a dramatic turn downwards as companies like Boeing, Ford Motor, and Marriott International all suspended their dividends in the 1st quarter of 2020. The cumulative effect on the S&P500 saw $4.2 billion worth of dividends eliminated during that timeframe, according to data from S&P Dow Jones Indices. Fast forward to 1st quarter 2021, only $0.5 billion of dividend cuts impacted the S&P 500 in this most recent quarter, a significant improvement. Furthermore, only two companies in the index suspended dividends this quarter versus thirteen a year earlier. Similarly, earnings have been impacted because of the pandemic which has resulted in artificially high payout ratios. We believe this impact is temporary and will normalize over time.

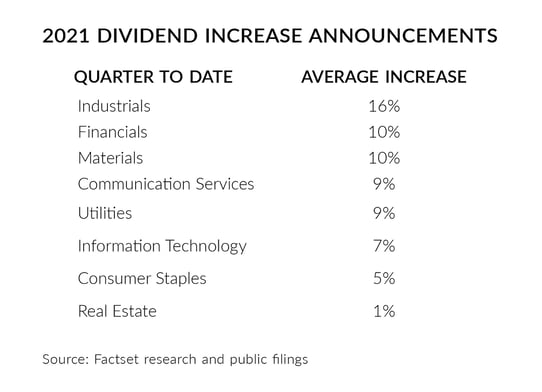

For the 1st quarter, 36% of our holdings announced dividend increases of 8% on average. Industrials saw the largest increases for the quarter and a full table can be found below (table 1). Broader based, we expect a slowdown of dividend increases for the rest of the year. We believe that the market will revert towards a mid-single digit dividend growth rate, but we are also encouraged by the breadth of dividend increases across sectors. In the coming quarters, we would also expect some of the larger money center banks to reinstate dividend growth as they have already received clearance from the Federal Reserve.

Earnings estimates for the S&P 500 continue to get ratcheted upwards. Q1 2021 earnings estimates on 12/31/20 expected a gain of 13.3% and have since been revised upwards to 21.1%. Similarly, full year 2021 estimates originally expected to grow +22.6% on 12/31 but now stand at +26.5%. Revenue growth estimates for 2021 also appear rosier as expectations are for growth of 9.6%, compared to 7.8% at the end of 2020.

Given the vast amount of stimulus spending we are anticipating a booming US economy in 2021 with GDP growth rates of 6-7%, something not seen since the 1980s. However, 2022 should see a slowdown in GDP growth as the effects of prior stimulus wear off but should still print above trend. Along these lines our portfolio is positioned with select companies for a reopening economy. We have also modified our weightings to our existing companies for greater potential exposure to infrastructure spending.

In the meantime, investors need to determine if they should continue to favor value over growth? We think the question is moot as we have found companies with both characteristics by having exposure in cyclical growth stocks in our portfolio. The stock market valuation recognizes this economic growth and is currently selling for 23x earnings compared to a five-year average of 17.8x.

We continue to see bubbles in the market whether it be from SPACs, hot IPOs, Reddit traders, or hidden derivatives in family office portfolios. Ultimately, we will continue to focus on quality companies that can absorb a correction that is inevitable in the stock market.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|