Despite the backdrop of record volatility, the Brentview Dividend Growth strategy outperformed the S&P 500, our primary index in the first quarter of 2020. On a gross basis our Dividend Growth strategy returned -18.25% vs. the S&P 500 total return of -19.60%. The year started out with typical seasonal strength as the month of January has historically been positive. Ultimately the otherwise complacent stock market was shaken as volatility surged as the quarter progressed.

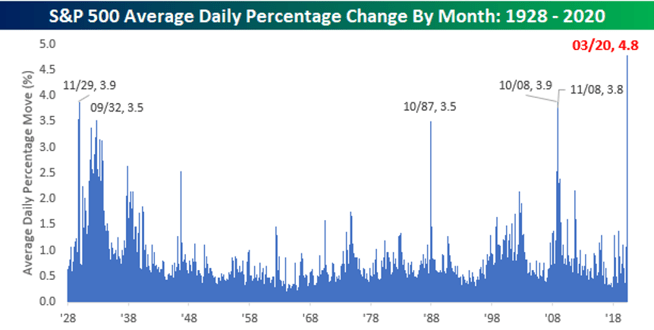

During the month of March, data shared from global health organizations underscored the quick spread of the COVID-19 virus. This news understandably caused concern among investors and equity markets responded with the highest measured volatility for the S&P 500 since 1928 as seen in (Chart1). We are grateful that our portfolio is constructed and designed with risk management in mind. During the month of March alone the Dividend Growth strategy had a gross return of -10.88% vs. -12.35% for the S&P 500. Ultimately our investment philosophy of “bend but don’t break” has designed a portfolio that drove our quarterly outperformance during the most stressed month in history.

Chart 1

Market Volatility Returns

Source: Bespoke Investment Group

As of the end of March our strategy track record attained a historical milestone of reaching fourteen-years in length. While our team has a longer history of portfolio management that pre-dates our strategy, there are meaningful lessons that we have learned over our collective careers that went into Dividend Growth’s formation. With an average experience of 34 years this was not the first market correction that our portfolio management team has weathered. Given the pace of this sell off we thought it made sense to review five key characteristics that have always been part of the strategy and guide our management process. Especially during markets like these having a repeatable discipline and methodology is important. This process is our compass that keeps us from getting off track from our goals of limiting downside risk during market declines while still participating during up markets.

The first quarter of 2020 will be etched in memories for a long time. The world’s equity indexes collectively plummeted with alarming speed as the quarter progressed. Despite the long-term and time-tested diversification benefits of asset allocation, no asset class was spared as the effects of the coronavirus reverberated across the globe, causing major market dislocations. The first quarter of 2020 was one for the record books. It was the worst quarter for both the Dow Jones Industrials since 1987 and for the S&P 500 since the 4th quarter of 2008 (The Great Recession). This recent experience provides the rationale for why the first characteristic was incorporated into Dividend Growth.

As an investor you can never know with certainty when a market correction will arrive. To help offset this ever-present blind spot, a portfolio benefits by methodically incorporating a range of companies with different characteristics to help further diversification. Unfortunately our experience has shown that too many investors focus only on what they believe are the best ideas, best sectors, or best industries, thereby tricking themselves into believing that they will be able to select the best performers on a go forward basis. Ultimately this approach may limit the type of company that investors might include in their portfolio. Diversification rules provide a framework which improve the odds of success and reduce the odds of failure.

We maintain a portfolio of companies that we believe are well positioned but also make sure to have representation across the sectors of the S&P 500 to further diversify our portfolio risk. We then add additional means of diversification. By design, our portfolio is diversified by possessing companies with varying ranges of beta (a measure of risk), dividend yield (from low to high), and dividend growth rates (from low to high). Our experience has also shown that too many dividend investors focus on only one type of dividend payer and its normally companies with higher yields and slow top line growth. This bias leaves those investors with a portfolio that may be overly reliant on certain sectors and therefore may perform erratically. In reality, combining dividend stocks with different yields and growth characteristics across sectors is very beneficial. Having this diversity helps offset the fact that no one knows which sector or industry will be impacted during a stock market sell off. Our portfolio design has historically served our strategy well through other bear markets by protecting to the downside while participating to the upside during bull markets.

Our second portfolio characteristic expands further on our first. Maintaining a portfolio of quality dividend growth stocks may improve your chances to perform well over a longer period of time. While it’s impossible to predict the future, we seek to identify fundamentally strong companies positioned for continued growth and possess resiliency in their organization. The durability and resilience of those businesses translate into the quality characteristics that we seek. Based on our experience, we know that every company will face a challenging period while still possessing compelling long-term fundamentals at some point. Maintaining a diversified portfolio will help mitigate that company specific risk should we have one company or sector face a difficult period.

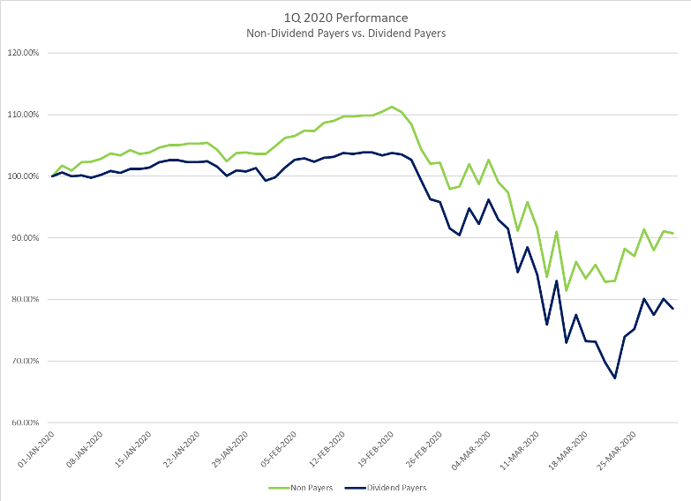

Our dividend growth strategy outperformed in both 2008 and the first quarter of 2020 under the same leadership team. What was different this time around was that dividend paying stocks did not hold up well in first quarter of 2020 like they did in 2008. In fact, as seen in (Chart 2) the collective cohort of dividend paying stocks under-performed non-dividend payers, which is especially surprising.

Chart 2

Non-Dividend Payers: Not your Traditional Safe Haven

Source: Factset

In short, it was a mixed bag for dividend stocks. Given the speed of the economic shock, which also coincided with an oil price war by Saudi Arabia and Russia, mature and cyclical areas were hardest hit. For the first quarter, Energy and Financials detracted the most while defensive sectors such as Consumer Staples, Health Care, and Utilities held up as expected. Non dividend paying biotech companies within Health Care and select Technology companies seen as beneficiaries of remote work did the best on a relative basis during this market decline. Given that each market downturn is unique, it will consistently humble any investor, which brings us to the third characteristic of our strategy.

Do not chase dividend yields as a reason to buy a company no matter how tempting. While we require every company in our portfolio to pay a dividend, in some cases “too much of a good thing” is telling you that something might be wrong. That is not to say that good companies can have elevated dividend yields temporarily and continue to pay their dividends. However, history has shown that most of the time when a company’s dividend rises to levels that are significantly higher than its peer group or sector, that company is likely to cut its dividend. Currently the entire energy sector along with select REIT’s and discretionary companies are in this category. We place a great deal of attention on determining a company’s commitment to their dividend, along with estimating the free cash-flow generation and assessing balance sheet strength. Historically some of our best performing companies never had high dividend yields because their stock prices rose faster than dividends. The result of owning these companies for longer periods of time meant the dividend yield on original cost basis (yield at cost) was dramatically higher than chasing yield at the beginning. The only thing that was required was time and patience.

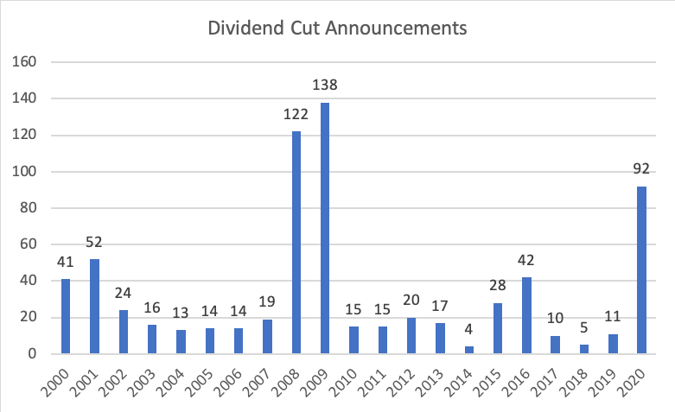

In today’s backdrop, yields for several sectors and companies have been shooting upwards towards unsustainable levels. One of our goals is to sell a company out of our portfolio before a dividend cut occurs. We may not always get those calls right, but in 2008 we were able to sell all the dividend cutters before they happened. However, as seen in (Chart 3) this most recent quarter dividend cut pace was incredibly rapid. In fact, when looking at all of the announcements, regardless of company size, the first quarter’s dividend cuts totals reached 75% of the total cuts that occurred in the entire year of 2008!

Chart 3

Dividend Halts are the new Dividend Cut

Source: Factset & 8k filings

Additionally, the 2008-2009 bear market saw dividend cutters predominantly coming from the financial sector. In today’s market, dividend cutting companies came from several sectors and most companies didn’t cut their dividend, they declared an outright suspension of the dividend. Time will tell whether or not these suspensions are temporary or permanent. Looking at all the filing announcements, it appears that greater than $15 billion of dividend payments were eliminated, with Boeing and Ford accounting for a significant portion of that total.

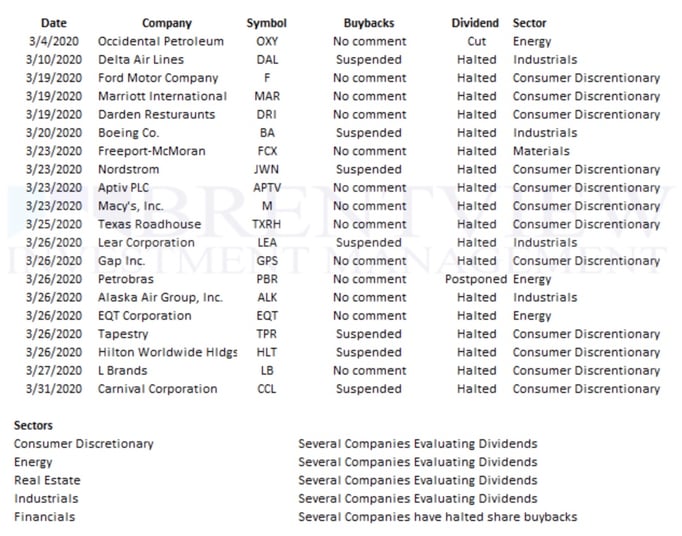

As seen in (Table 4), looking at companies with market caps $2 billion and above, the Consumer Discretionary sector was most affected from social distancing shutdowns. This sector’s constituents include travel, restaurant, leisure and retailing businesses.

Chart 4

Brentview Investment Management

Buyback & Dividend Tracker

Source: Factset Research & Individual Company Public Filings

The table above is provided for informational purposes only, is not an endorsement of any security or sector and may not include all recent dividend disclosures. Only companies with market caps above $2 billion were taken into consideration for this list. The commentary should not be seen as a solicitation or offer to but or sell any securities. Information provided is deemed to be reliable but is not guaranteed and should independently verified. This table does not correspond to any of our portfolio holdings.

Portfolio management, even in a portfolio with low turnover, is an ongoing process. In mid-2019 we started to tilt our portfolio weights towards a more defensive posture. Our concerns related to corporate debt levels and the burgeoning pace of low investment grade issuance. Normally 25% of the corporate debt is comprised with companies that possess BBB ratings. Today, however, it is closer to 50% of the constituents. The current environment is froth with uncertainty and we seem to be in uncharted waters. Investors are now focusing on tracking COVID-19 cases instead of corporate earnings, which ties into to the fourth attribute of our strategy. When selecting a company, we combine both qualitative analysis with financial analysis in order to identify the right company that we can preferably own for several years.

Qualitative analysis is important because it provides a necessary step that is critical for owning companies for a long period of time. In order to gain and maintain conviction in a company it’s important to understand how resilient that company is throughout an economic cycle, especially when an economic downturn is severe. For this reason, we look for answers about the company’s competitive positioning, earnings consistency, and reliability of management. When combined with understanding the company’s commitment to dividends, we gain greater conviction in that company. In regard to financial analysis, estimating future earnings, revenue, and free cash flow growth will help determine if the valuation at purchase is attractive.

Where do we go from here?

While pandemics are not new, it’s a new experience for most of us today. We believe that human innovation will prevail but it will take time and patience. Previous cases of SARs and MERS saw impact in various countries but COVID-19 has impacted all populated areas around the globe. Are our lives changed forever where we wear masks every day? Will we have a V economic recovery or will it be more like a U or even an L? What industries and sectors will be affected or actually thrive in this new environment? While some of these questions will take time to discern, we believe that normalcy will return and a U shaped recovery seems the mostly likely outcome. Brentview took advantage of the recent market downturn by building initial positions in high-quality companies with strong balance sheets and robust cash flows during this past quarter. We funded these purchases by selling or trimming positions that we believe will face either longer-term operational headwinds due to COVID-19 or have experienced significant outperformance and fuller near-term valuations. We sold out of positions in the Financial and REIT sectors and used those proceeds to initiate positions within the Communication Services and Industrials sectors. Finally, we swapped two companies within our Consumer Discretionary exposure.

Now more than ever, stock picking backed by fundamental analysis is paramount. We expect that certain businesses will thrive unabated due to the changing landscape. This leads us to the final trait of our strategy; a buy or sell decision should be driven by fundamentals. It’s tempting to make several portfolio moves during volatile periods. However, portfolio moves should be determined by observable measures, be it from valuation, business mix, margins, or the balance sheet for example. We believe that businesses tied to cloud computing should do well as a virtual work environment may stay with us longer or become a permanent fixture in our economy. This potential shift in behavior doesn’t bode well for landlords (REITs) as residential tenants are not paying rent. In the commercial retail segment, tenants like Cheesecake Factory have announced that they cannot pay their leases in order to conserve cash.

Another trend that seems to be intact in a post COVID-19 world is within wireless networking. Spending on 5G upgrades will continue to grow in this environment as major telecommunication carriers reinvest in their network systems. Related to the growth of 5G, select semiconductor companies should stand to benefit as well. Once moribund PC sales are now growing and software such as Skype, Zoom, and most recently Tik-Tok are changing the way we interact with each other and are thriving as an outlet for social interaction and entertainment. Consumer behavior may also change after this crisis. Despite a huge stimulus bill with checks going out, most Americans say they will save this money and perhaps be thriftier. Once travel restrictions are removed, we believe the travel and leisure spending will remain muted but a snap back in apparel and beauty spending could occur. Conversely the now popular staples companies might face difficult comparable sales given that our pantries are full of household products. Large ticket items like autos and housing will likely be constrained as double-digit unemployment rates will take time to abate.

As these developments unfold, we will continue to monitor our individual companies by conducting our ongoing maintenance research. In the near-term earnings announcements will provide a lot of clues and forward commentary will shed some light on how each business is adapting.

We are especially appreciative of our clients, knowing the trust they have placed with us, and we will strive to perform to our best. Please remain safe and healthy during these challenging times, like always, resilience will prevail.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|