Regardless of timeframe, our never-ending responsibility is to assess fundamentals of companies that we either currently own or are interested in potentially buying. To this end, we have reviewed our portfolios and underlying companies within the S&P 500. Information was derived from the most recent annual report figures published by the index constituents. Below are some of some of our key findings.

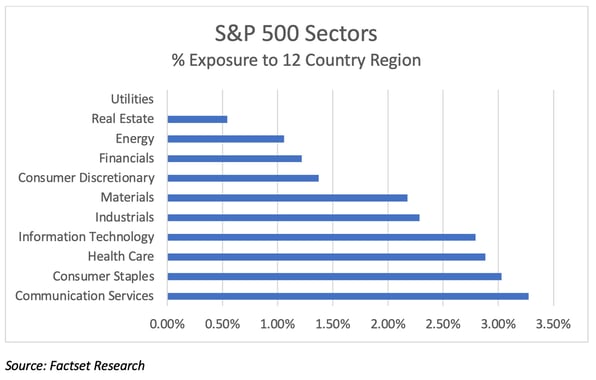

To get a better understanding of evolving business risk, we analyzed revenues generated from twelve countries in the impacted region. While Russia and Ukraine are clearly areas of focus, peripheral countries such as Belarus, Finland, Georgia, Hungary, Latvia, Moldavia, Poland, Romania, Slovenia, and Sweden were also reviewed. Since the S&P 500 is comprised of large established multinationals, almost every sector, with exception to Utilities has some exposure to the collective region.

As a result, and seen in chart 1, Communication Services has the largest average revenue exposure among the eleven GICS sectors. The Consumer Staples sector is the second most impacted sector while Health Care was third most exposed to the region. What’s even more interesting is that when looking at revenue thresholds, non-payers, have a higher percentage of total constituents in their category.

Chart 1

Digging in deeper

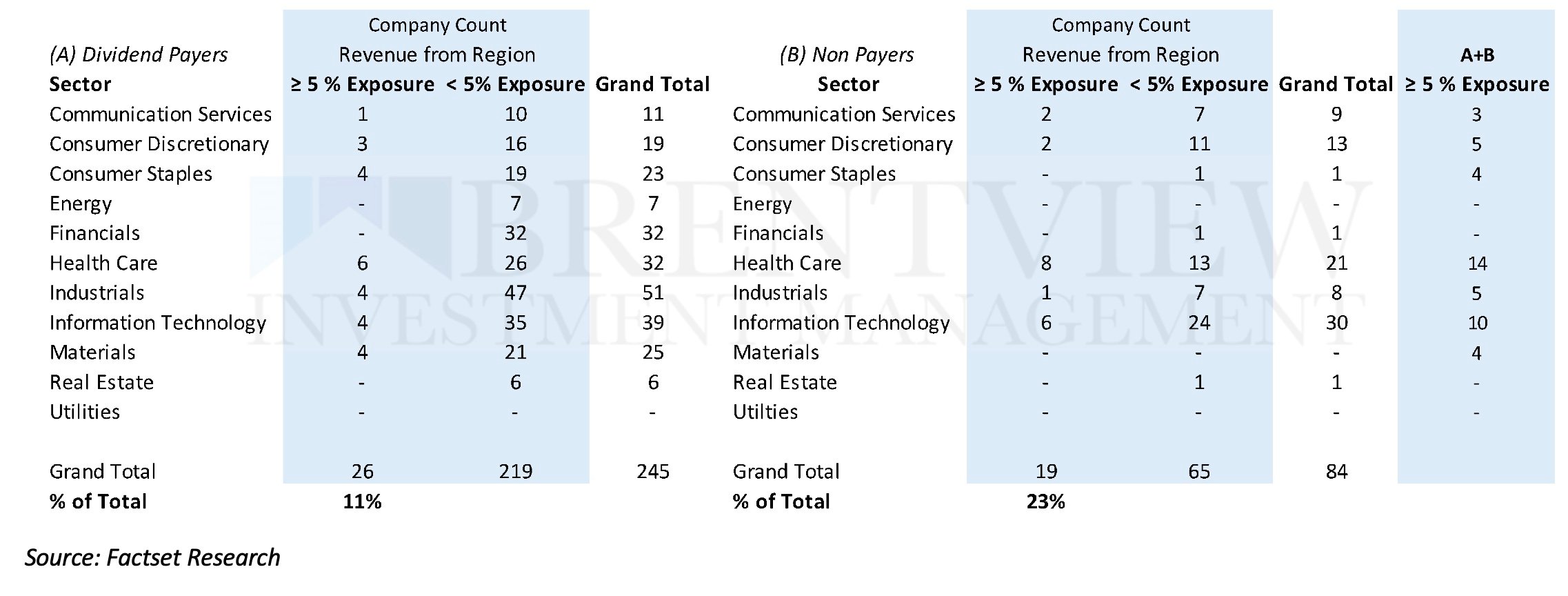

Using a revenue threshold of “greater than 5%” from the region, we were able to determine a company count for each sector and classify into either greater than 5% or less than 5%. This analysis removes all companies with no exposure whatsoever. As seen in table 1, Category A, on the left side, includes only the dividend payers found within the S&P 500 while category B, on the right, includes the non-payers within the sector.

Overall, companies found within the Financials, Real Estate, and Utilities have no exposure over 5% of their revenue generation. It’s also important to note that our analysis captures direct geographic revenue derived from the region, and therefore the Energy sector will have some indirect impact which is not fully captured in this analysis. Conversely, Health Care and Information Technology have the highest count of 5%+ companies. What’s especially interesting is that when looking at each category A, or B, the non-payers found in category B have a greater percentage of exposure overall. Nineteen of the eighty-four companies, or twenty-three percent, has greater than 5% of revenue coming from the region. Conversely, only eleven percent of the dividend paying category has greater than 5% of revenue coming from the region.

Table 1

What is Brentview doing?

We expect continued volatility as the market digests the constant news flow from the region while investors attempt to assess the economic impacts. Given how quickly the crisis elevated, it can also deescalate with a diplomatic solution. Ultimately, we believe company earnings, resilience, and forthcoming quarterly commentaries will be key to the remainder of 2022 performance. We take some measure of relief that our dividend growth research process seeks out well capitalized companies with management teams that are very capable in running their respective businesses. However, we will continue to evaluate the fundamental impact from each company, and how it might influence their outlook and earnings. The potential for “knock on” effects remain as supply chain issues, shortages, or remaining impact of trade sanctions play out. We believe that concern about downside risk is warranted but we do not believe that investors should modify their long-term investing plans at this time.

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|