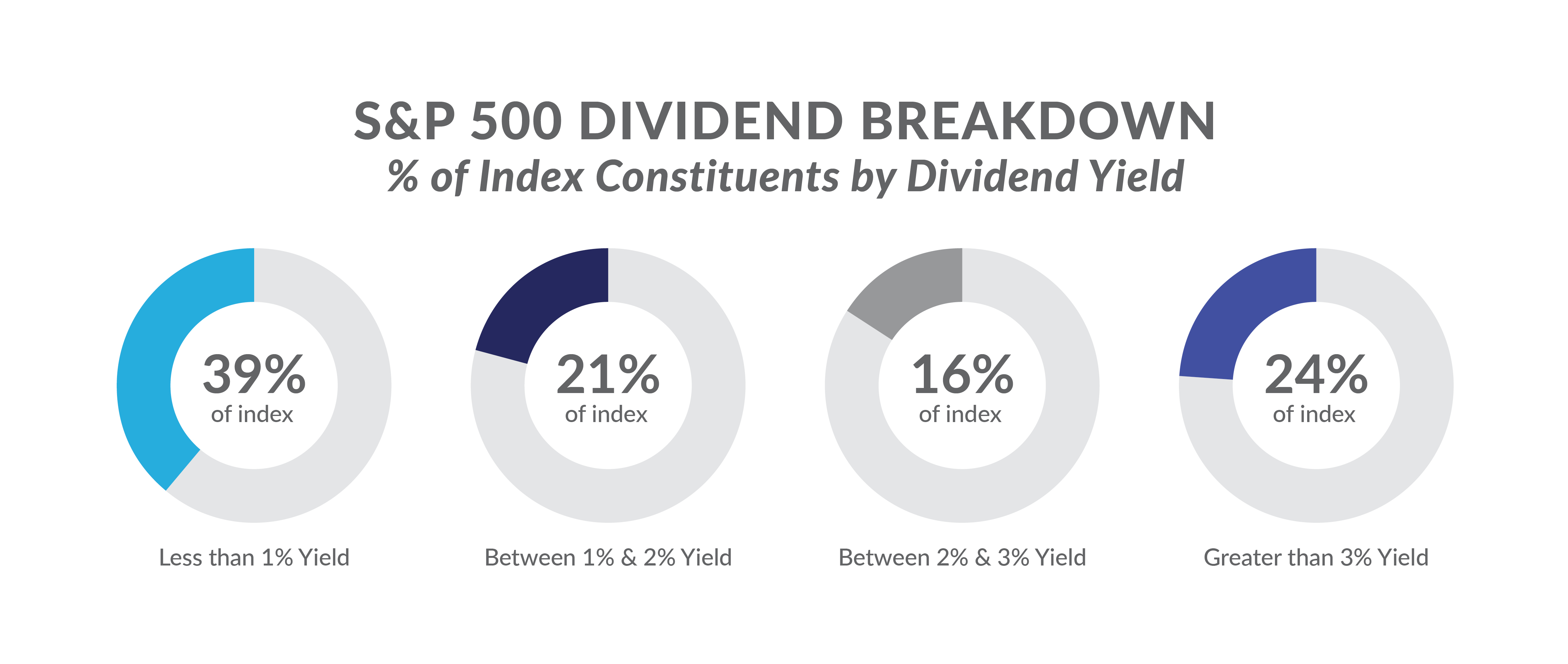

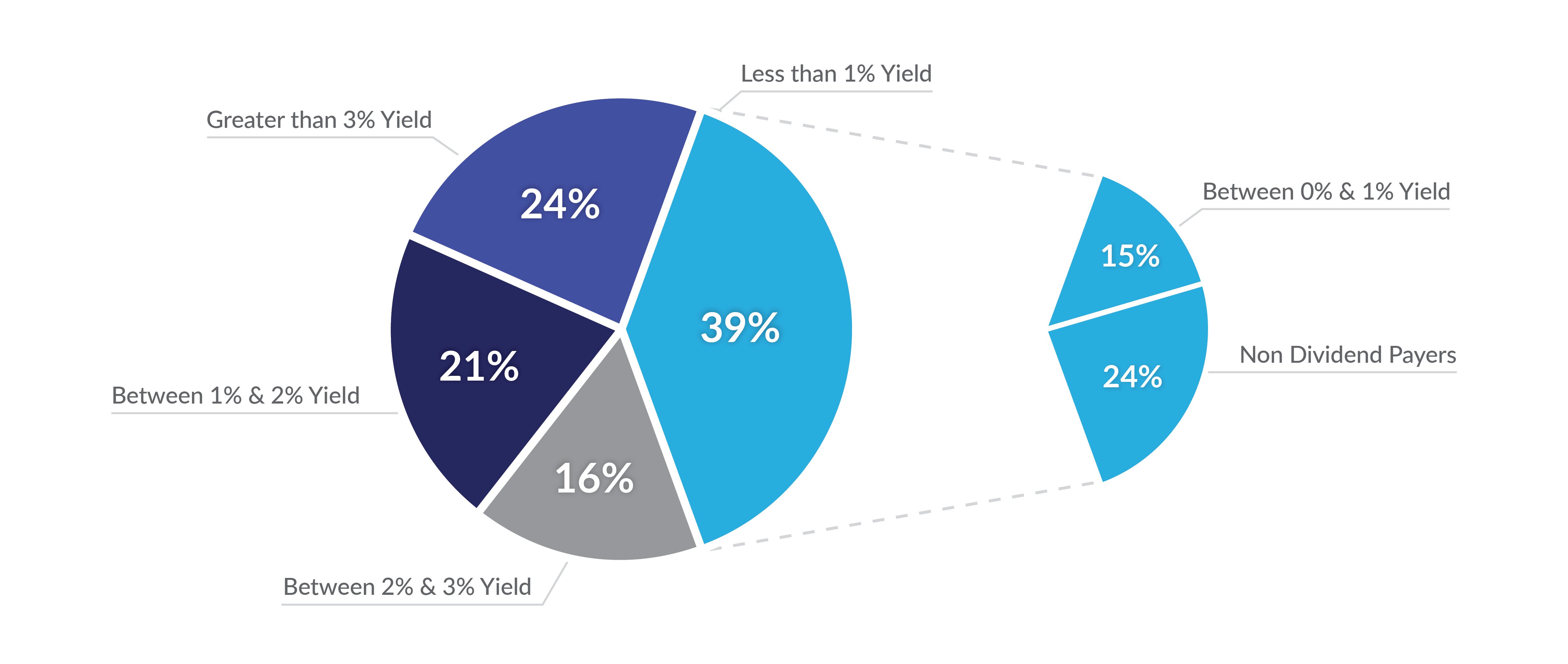

Many dividend investment strategies, both active and passive, often have minimum dividend yield requirements. This methodology eliminates a sizeable portion of their respective investible universes. For example, within the S&P 500 Index, stocks with a dividend yield1 less than 1.0%, represent 39% of the index constituents2.

While that seems like a large proportion, it also includes stocks of companies that do not pay dividends (62% of the cohort and 24% of the index). However, it also includes stocks with dividend yields between 0% and 1.0% (38% of the cohort and 15% of the index) such as Apple, Visa, Nike and Costco.

What makes Brentview's approach unique is that even though our portfolio overall yield is greater than the S&P 5003, we also focus very carefully on lower yielding stocks and recent dividend initiators. We find that often these are the most robust growers. We try to balance between higher yielding stocks with relatively low earnings growth and lower yielding stocks with higher growth rates. This is something that many other dividend strategies do not incorporate into their portfolio construction framework.

1 Forward Dividend Yield

2 Source: Morningstar®

3 As of 09/30/2020

This commentary reflects the views of the Brentview Investment Management and is subject to change as market and other conditions warrant. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, sector, or index. The commentary should not be seen as a solicitation or offer to buy or sell any securities. The advisor (Brentview Investment Management, LLC), and their employees and clients, may hold or trade the securities mentioned in this commentary. Diversification does not guarantee a profit or eliminate the risk of a loss. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS.

If you would like to learn more about Brentview Investment Management and the Dividend Growth Strategy please, click here

|

|

|